Sabadell share price and market performance during the quarter

Macroeconomic news and highlights related to Sabadell share price during the quarter

The last quarter began with the downward revision of growth forecasts for the main global economies issued by various international institutions. The Bank of Spain (BoS) revised its growth forecasts for Spain’s GDP downwards by -1.5 percentage points to 1.4% for 2023. This is explained by the higher inflation expectations, less favourable funding conditions and the weakening global demand.

At a sector level, the Eurozone and Spanish supervisors urged the banking sector to exercise caution and greater risk awareness in the current environment. In this respect, the BoS asked banks to increase their provisions and to be careful with their capital planning.

A number of other factors impacted on the financial markets in the quarter. Among them, the improved situation concerning the energy crisis in Europe, expectations of a gradual easing of the zero-Covid policy in China, and greater political and economic stability in the United Kingdom following episodes of volatility experienced towards the end of 2022.

In particular, in the last month of the year, due to the persistence of inflationary pressures affecting global economies, the Central Banks continued to sound hawkish at their last meetings of the year. For its part, the European Central Bank (ECB) raised interest rates by 50 bps to 2.50%, consolidating an overall rise of 250 basis points over the year. In addition, the European Monetary Authority confirmed that it will continue to make significant rate hikes until inflation reaches 2%. The 12 month Euribor ended the year above 3.3%, its highest level in more than a decade.

In this context, the Sabadell share price had appreciated by +58% at year-end, placing it above the average of its Spanish peers (+28%). In addition, the share price appreciation was the second highest among IBEX-35 stocks in the year, and the highest in the period 2021-22. At European level, it ranked in third place among more than 40 banks that comprise the European banking sector index, in the cumulative period 2021-22.

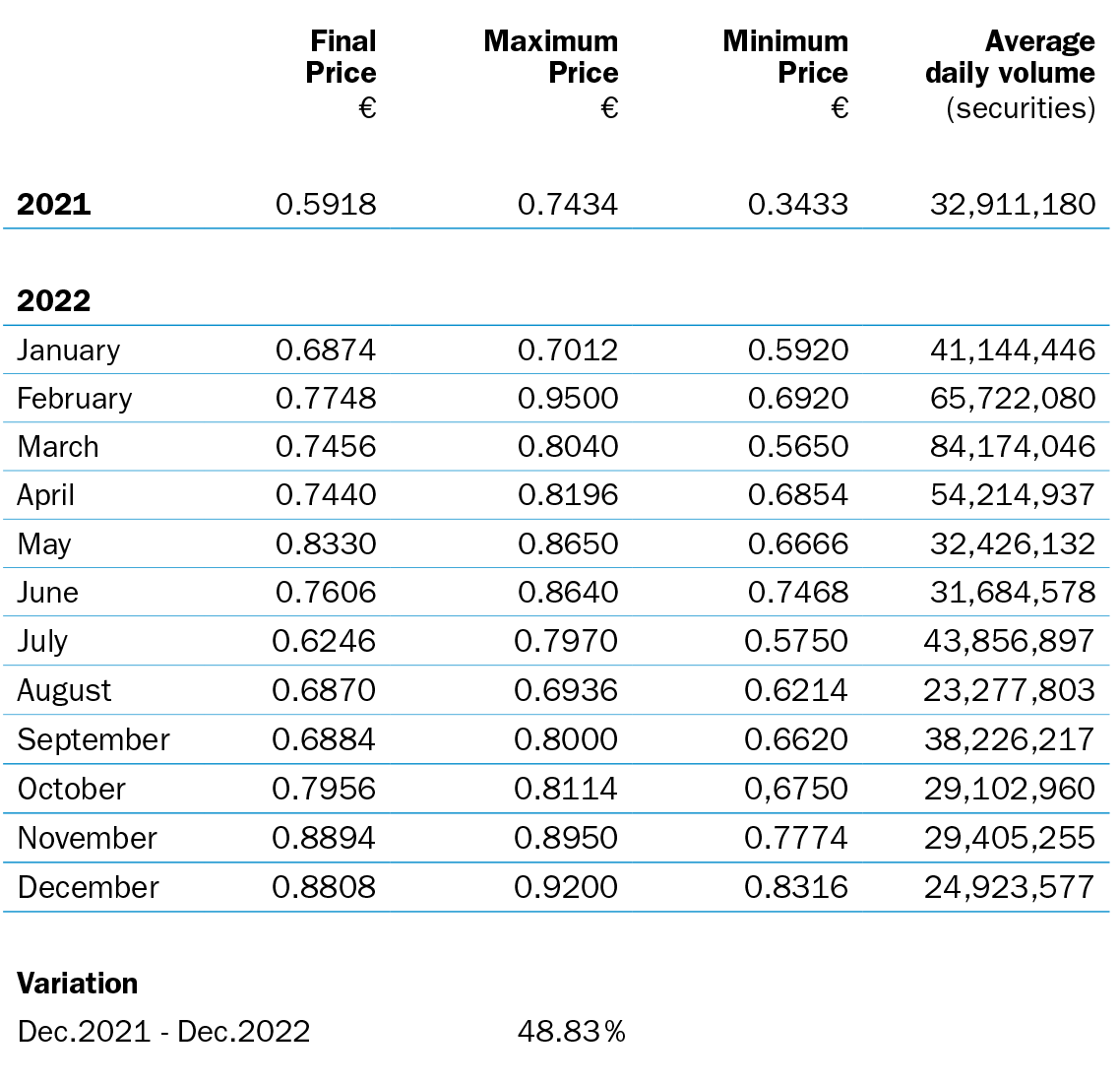

Sabadell share price and volumes

Information about month-end prices and average daily volume of securities traded

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

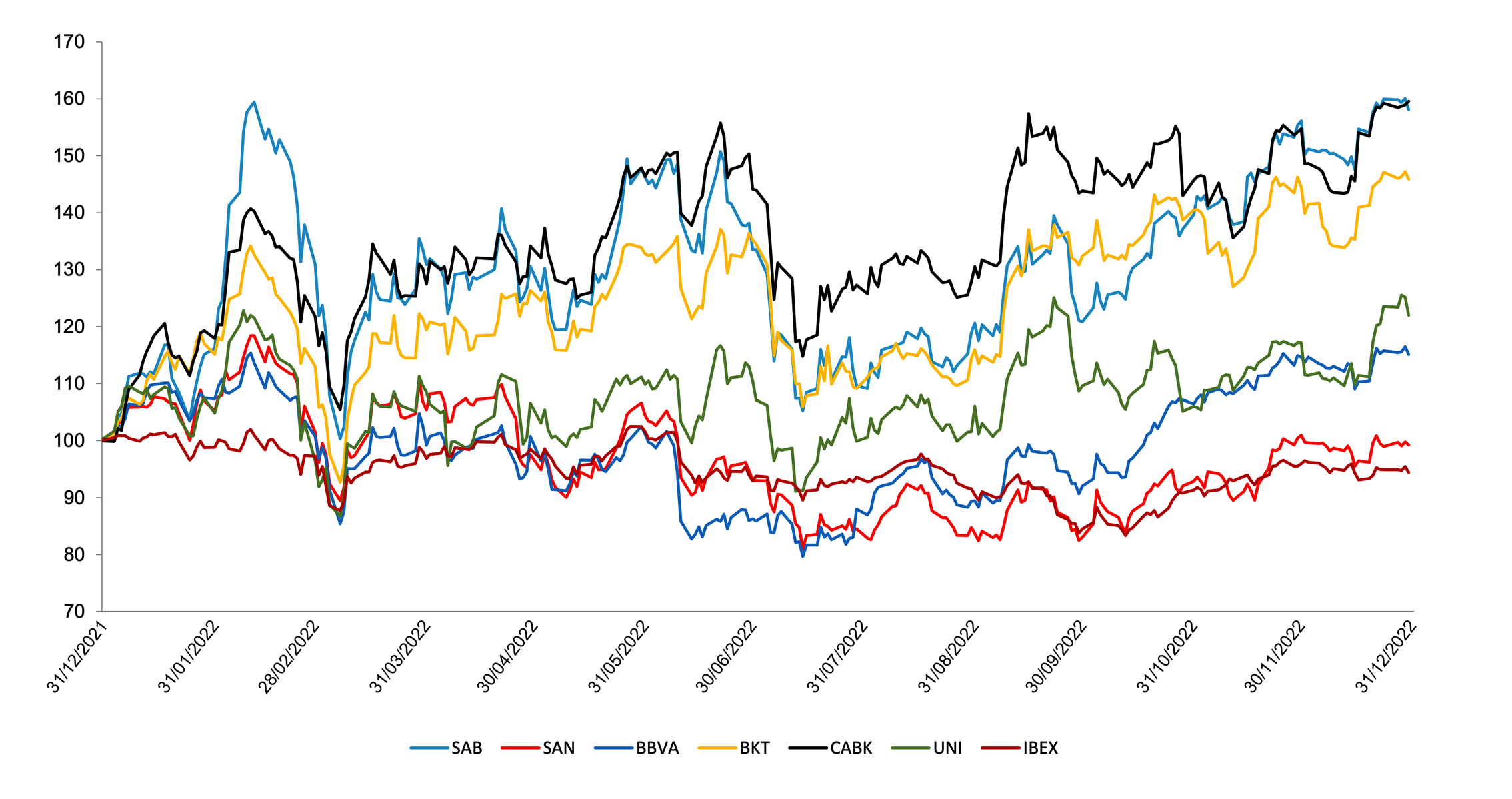

Share price performance

Graph showing share price performance of Sabadell and other Spanish banks listed on the stock exchange

*Source: Bloomberg. Data rebased to 100 at the start of the period, adjusted for capital increases, dividends, stock splits, etc.

Quarter-end technical data

Key indicators of the Sabadell share for this quarter