The global economic environment has been somewhat fragile in the second quarter of the year. In terms of productive activities, the manufacturing sector is undergoing an adjustment following the post-pandemic boom and as a result of the tighter monetary policies implemented by the main central banks over the past year. The real estate market remains among those most affected by the new interest rate environment. In labour markets, on the other hand, unemployment rates remained at record lows.

As for monetary policies during the quarter, the main central banks appear open to continuing with their monetary policy tightening. Specifically, the ECB set the marginal deposit rate at 3.50% and left the door open to future hikes.

In terms of the Eurozone, after falling into a technical recession in the first three months of the year, having recorded slightly negative growth (-0.1%) for two consecutive quarters, activity indicators now point to slight growth in the second quarter of the year. Nevertheless, it is worth noting that the economy in the European periphery is doing better than the rest of the Eurozone, thanks to the recovery of tourism, the boost offered by the European NGEU funds, and the area’s more limited exposure to Russian gas.

The economy in the United States, on the other hand, is proving to be more resilient than expected, although analysts still anticipate a slight recession towards the end of the year.

If we focus on the financial markets, these performed better in the second quarter after the situation in the banking industry became more stable thanks to an effective management of the problems experienced by US regional banks and Credit Suisse. Against this backdrop, market expectations for official interest rate hikes rose and government bond yields rebounded sharply, nearing and in some cases even exceeding the levels reached before the bank turmoil. Risk assets, for their part, posted gains at the end of the quarter, particularly US stocks, which were driven by the tech industry.

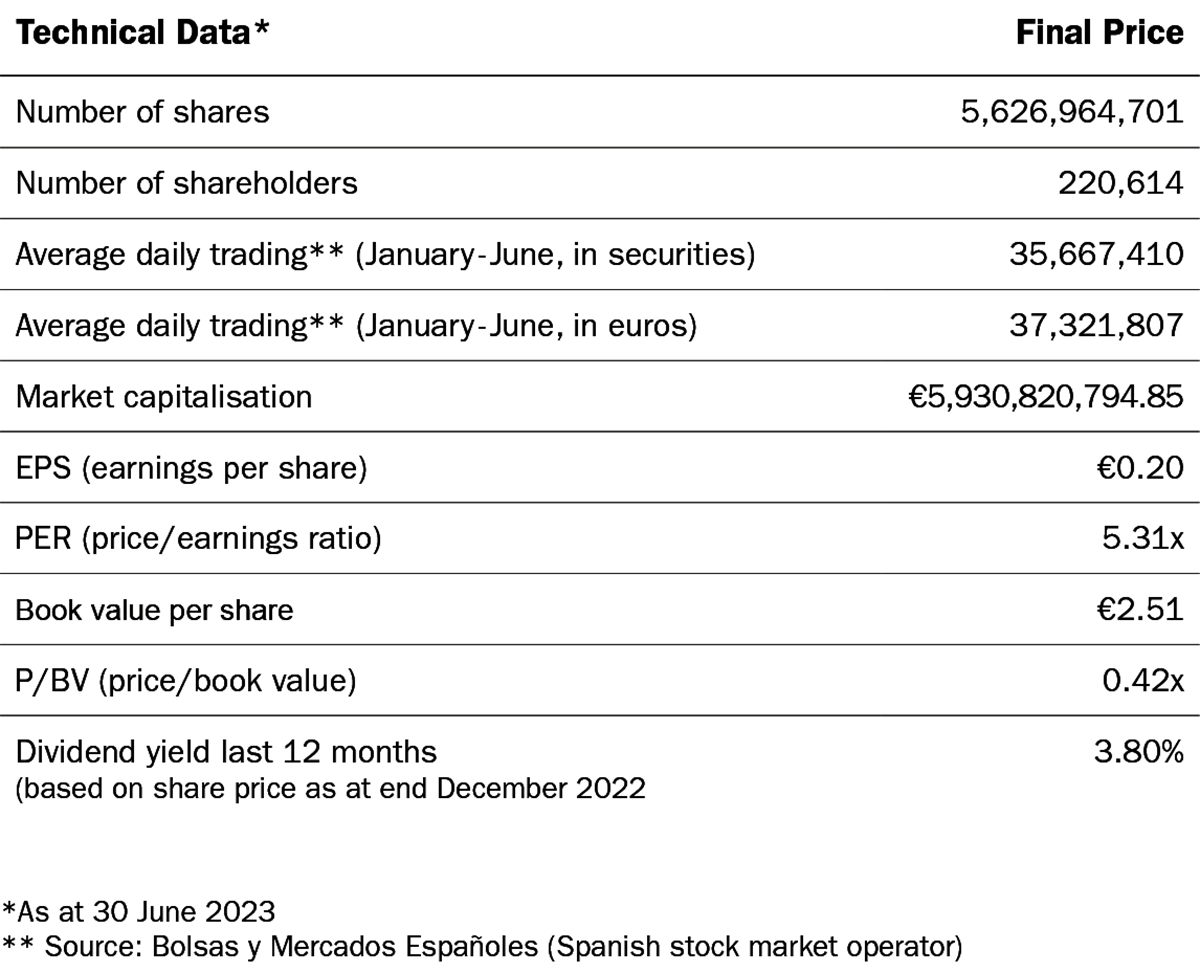

As for Banco Sabadell, it is worth noting that rating agencies Standard & Poor’s and Fitch both raised their outlook from neutral to positive, reflecting expectations of improved profitability. On 30 June, the ECB granted authorisation to execute the share buyback, to be paid out of 2022 earnings, announced as part of the shareholder remuneration policy and approved at the Annual General Meeting held on 23 March.

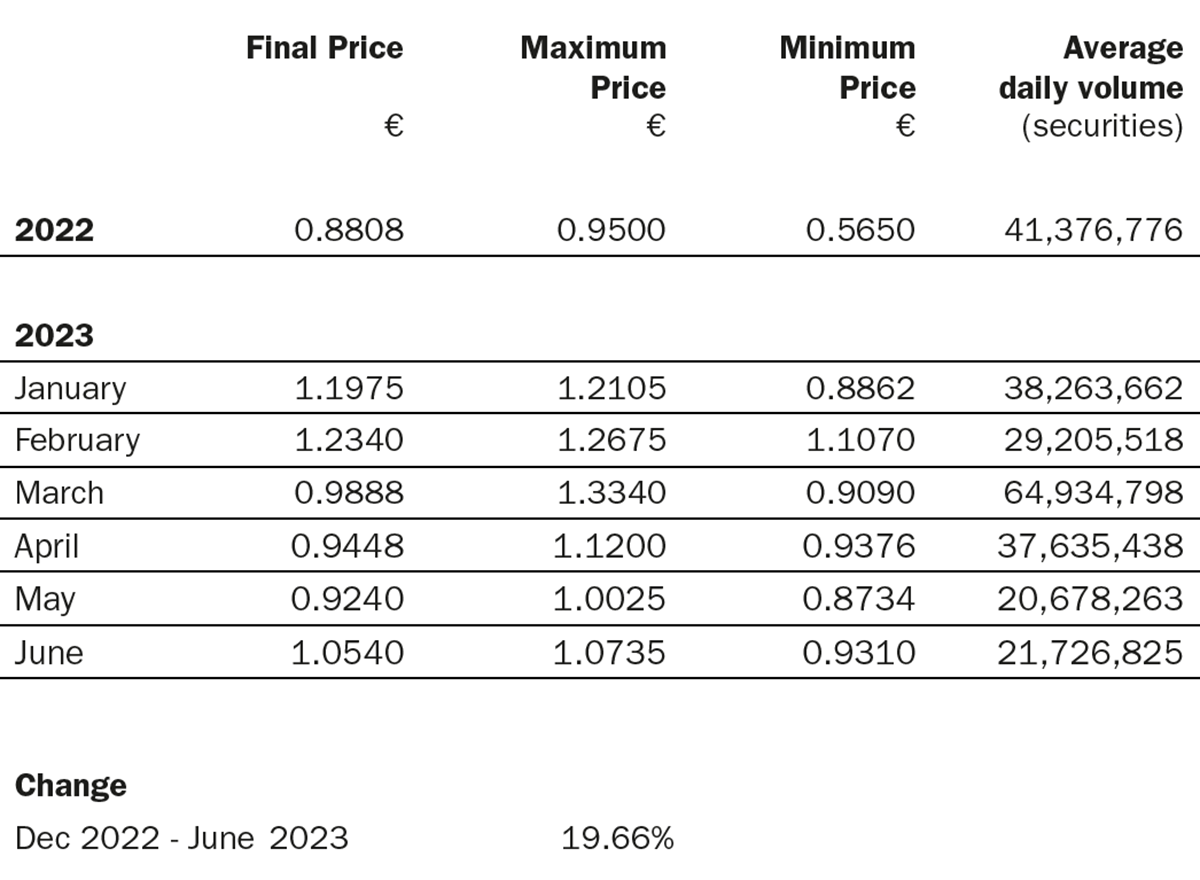

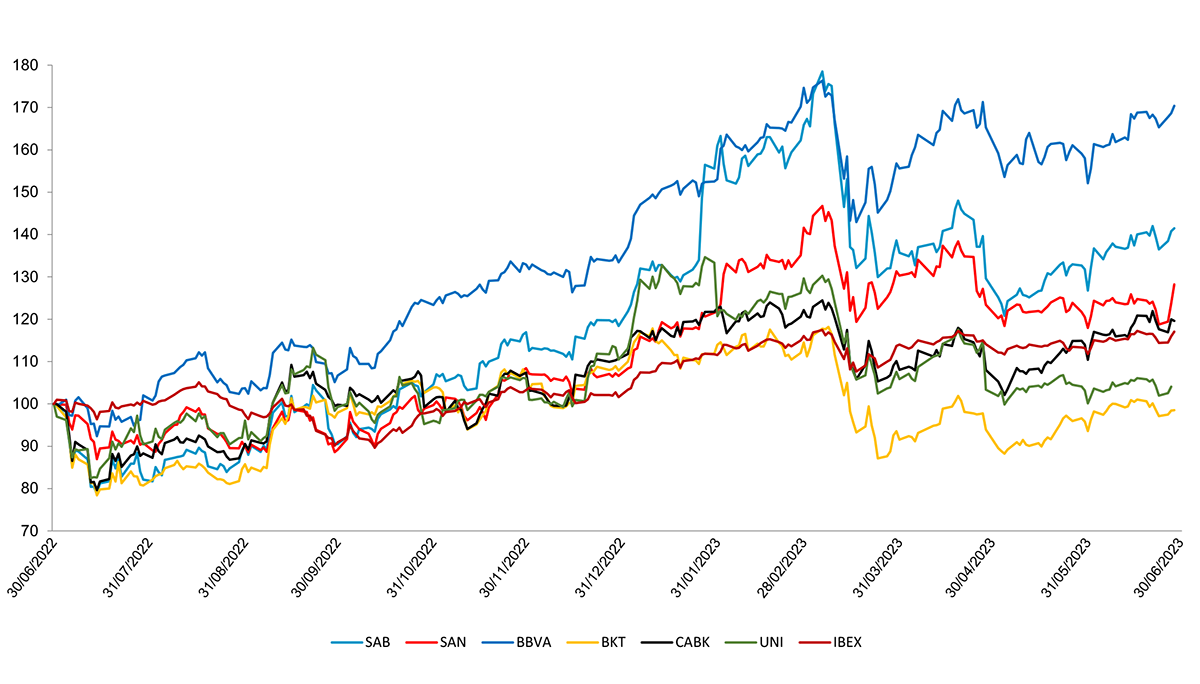

All in all, the Sabadell share ended the quarter with a revaluation of +6.6%, bringing the cumulative year-to-date revaluation to +19.7%, which is above the average of Spanish banks and of the European banking industry.

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

R.I. : 202300197-21-1-11077