During the third quarter of the year, the economy continued to show signs of weakness in the Eurozone, the United Kingdom and China, in stark contrast with the other side of the Atlantic, where the United States in particular recorded positive data.

In Spain, interest rate hikes impacted the housing market, with double-digit declines in both sales and new mortgages. In counterpoint, labour market data was robust, with a record-high number of persons in employment (in Spain, the employed population reached the figure of 21 million for the first time ever), while the unemployment rate fell to its lowest level since 2008.

The UK economy was largely stagnant, due to the current deterioration of its real estate sector.

In the case of the US, consensus has continued to push back the moment at which the economy might fall into recession, with that moment now standing more clearly in Q1 2024. In spite of this, there are still downside risks for economic growth.

As for the main central banks, the European Central Bank (ECB) raised interest rates in July and September, placing its deposit facility rate at an all-time high of 4.00%. The ECB suggested that September’s hike could be the last, but stated that it would keep rates at restrictive levels for as long as necessary to return inflation to its target level.

The Federal Reserve (Fed), for its part, adopted a hawkish tone. In September, members of the Fed forecast one additional rate hike for this year, while at the same time anticipating drops of just 50bps in 2024 (compared to their previous estimate in June of -100bps).

At the end of September, the Bank of England kept its base rate steady at 5.25%, after raising it in August to fight inflation.

With regard to Banco Sabadell, it is worth mentioning the results of the Stress Test, which were published by the EBA on 28 July, in which Sabadell improved on its results of the previous testing exercise corresponding to 2021. These improved results are evidence of the improved structural capital position and risk profile of European banks and, in our case, of Banco Sabadell.

At the end of August, Banco Sabadell issued a 6-year €750m senior non-preferred bond, with an early call option in the fifth year (6NC5) and a 5.625% coupon. This new issuance was very well received and launched alongside a buyback to repurchase bonds from a senior non-preferred issue due to mature in less than a year.

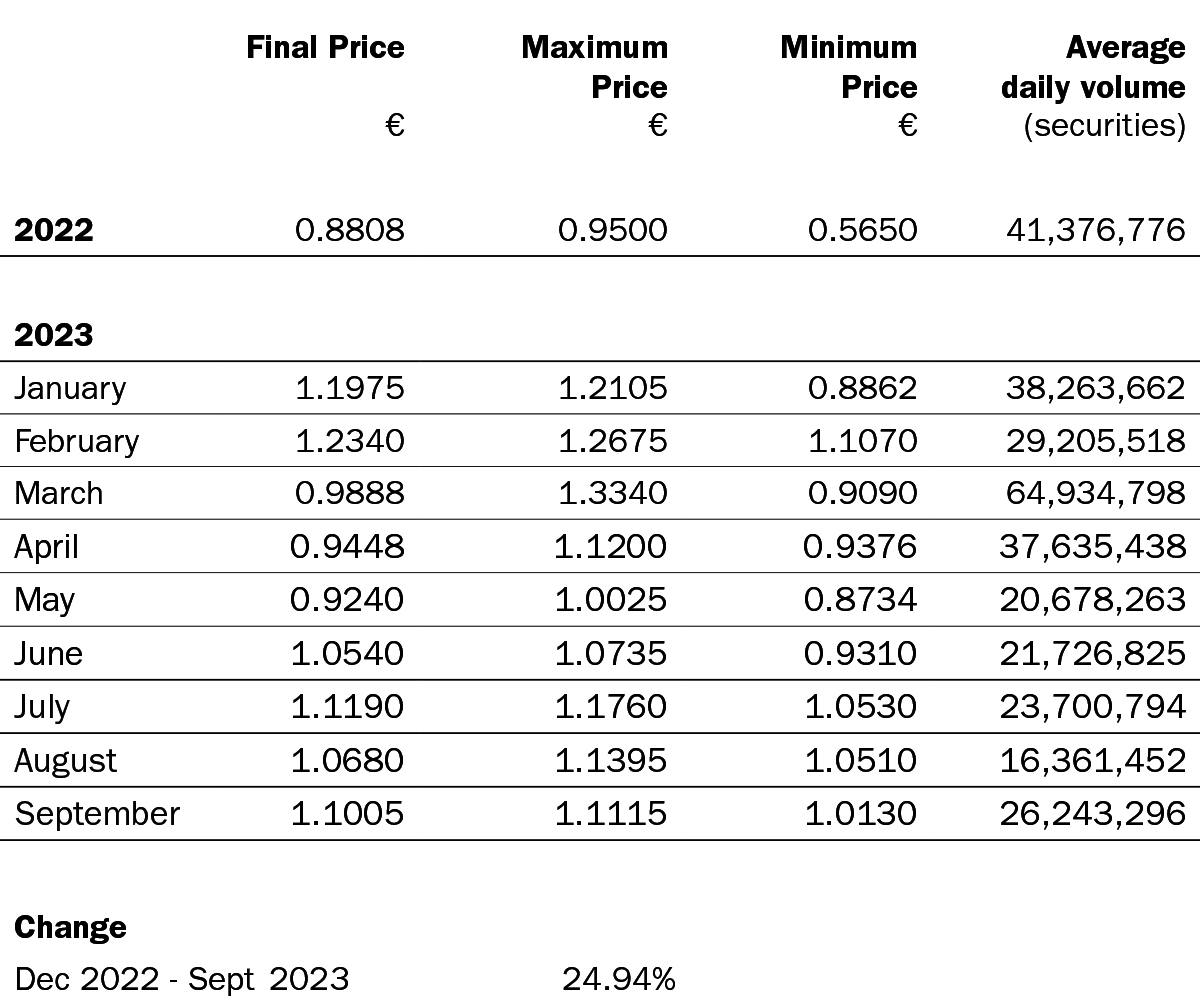

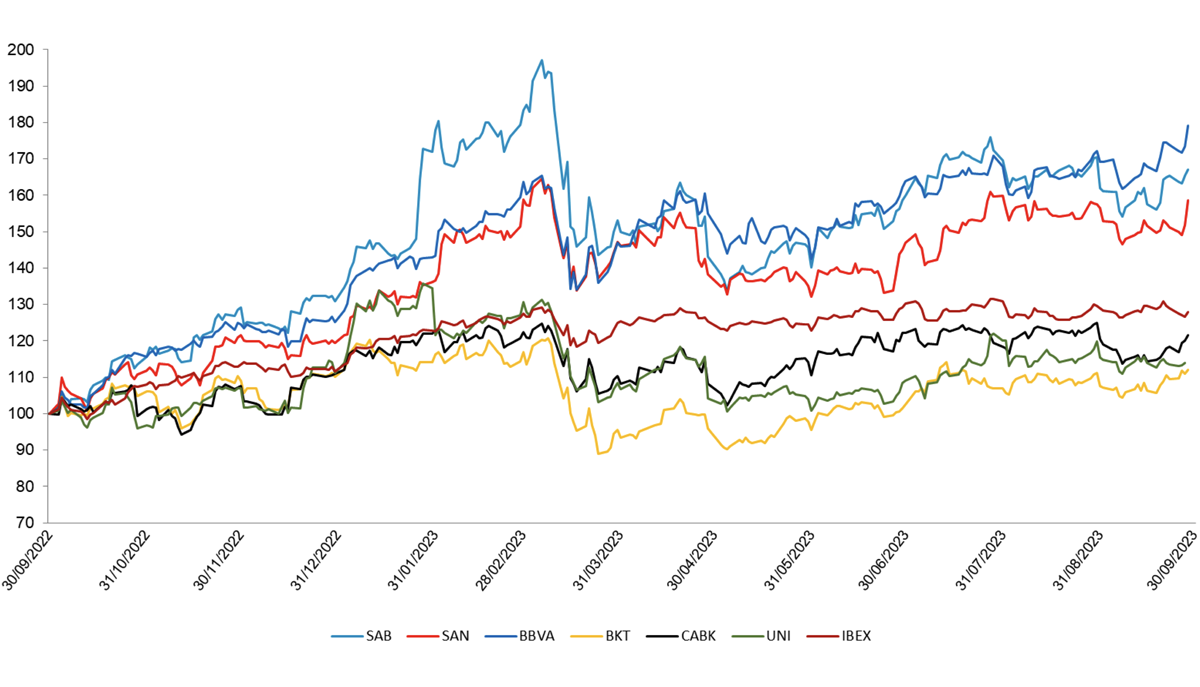

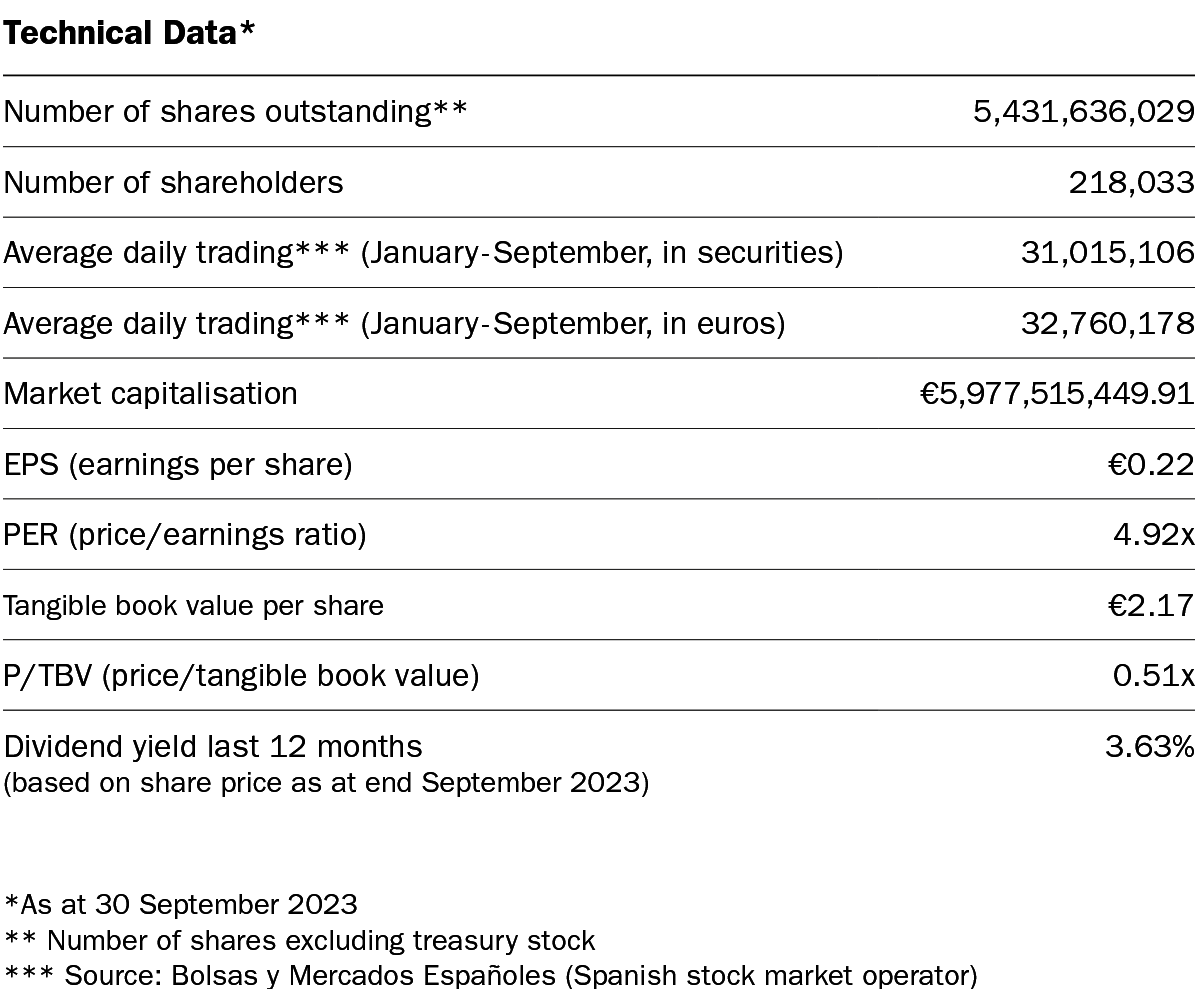

As at the end of the third quarter, Sabadell’s share price closed with a revaluation of +4.4%, bringing the year-to-date revaluation to +24.9%, above the average of Spanish banks, the IBEX 35 index and the European banking industry.

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

R.I. : 202300197-21-1-11077