Economic activity continued to show signs of fragility in the Eurozone in the last quarter of 2023, particularly in Germany, while in the United Kingdom, the economy continued to contract. The situation in other geographies differed, with the United States continuing to demonstrate resilience, benefiting from GDP growth at its highest level since 2021 bolstered by the contribution of the private sector, and with China showing a favourable progression in the last part of the year.

With regard to Spain, the economy continued to demonstrate some dynamism in its growth. The data at 4Q23 indicate that economic activity was at least as dynamic as it had been in 3Q23 when it grew by 0.3% quarter-on-quarter.

The labour market continued to show resilience in the main developed economies. In that respect, the unemployment rate stood at historic lows in the Eurozone, reaching 6.4% in November.

Inflation moderated throughout 2023 in the main developed economies, although in the last part of the year the non-core component, specifically energy, has rebounded to some extent. Even though some price moderation has already been achieved, it is proving difficult to attain further price reductions until monetary policy objectives are met.

With regard to the central banks, the European Central Bank (ECB) maintained the deposit rate at the record high level of 4.00% and insisted that it would keep rates at restrictive levels for as long as necessary.

The Federal Reserve, on the other hand, kept US rates unchanged in the range of 5.25-5.50% during the quarter. At its December meeting, the tone was somewhat more relaxed and opened the door to discussion of future rate cuts.

In December, the Bank of England kept its base rate at 5.25%, considering any discussion of rate cuts premature whilst stressing that its monetary policy will have to remain tight for a prolonged period.

In terms of aspects specific to Banco Sabadell during the quarter, in October, the rating agency Moody’s upgraded Sabadell’s credit rating from Baa3 to Baa2 and rated its outlook as Stable. This rating upgrade reflects the Institution’s improved risk profile and profitability in the current interest rate environment. On the other hand, in November, Sabadell completed the share buyback programme launched in the summer, in the amount of 204 million euros. Lastly, this month, Sabadell publicly disclosed its capital requirement following the supervisory review and evaluation process (SREP), which entailed an increase of its Pillar 2 requirement by 10bps.

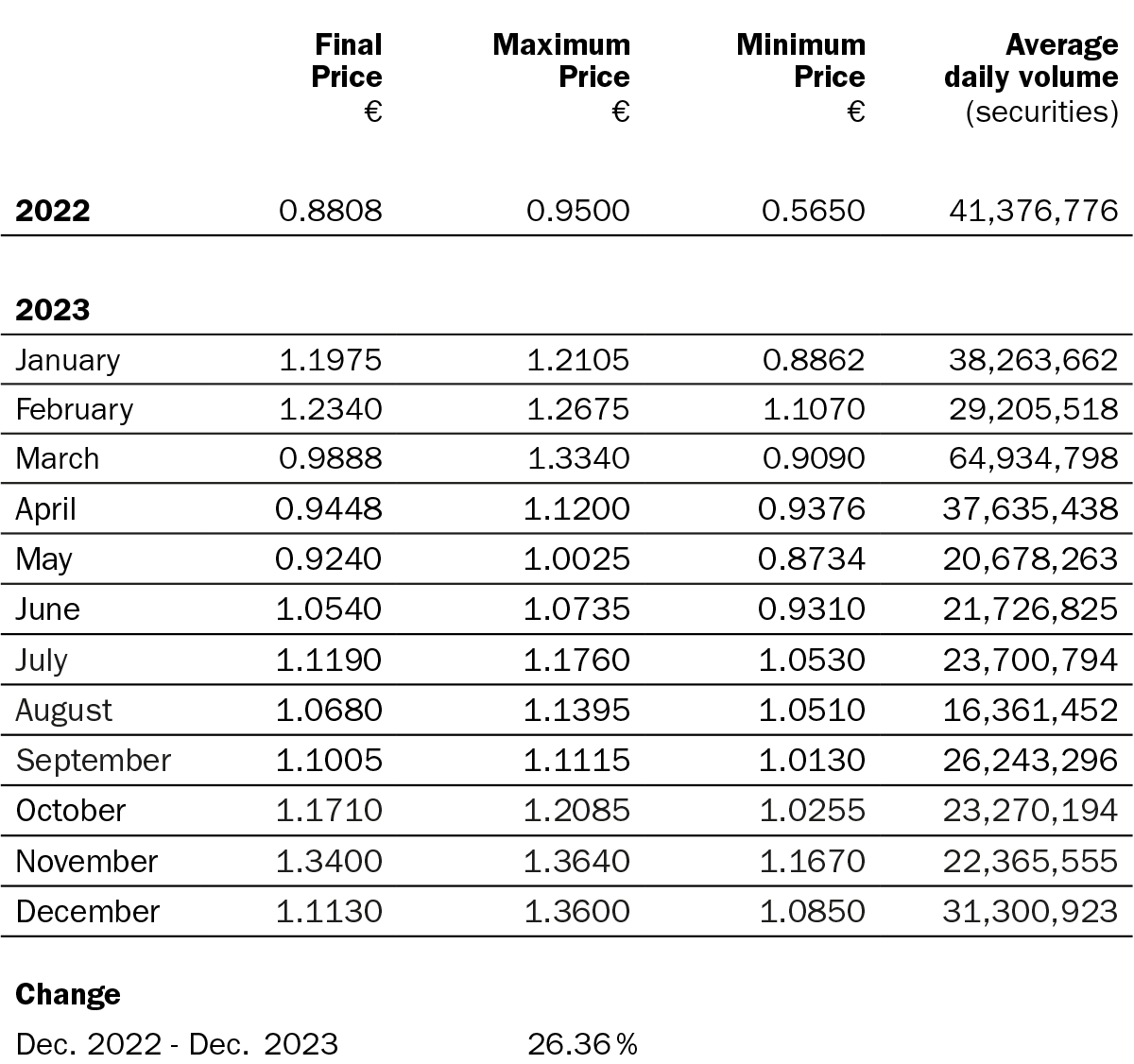

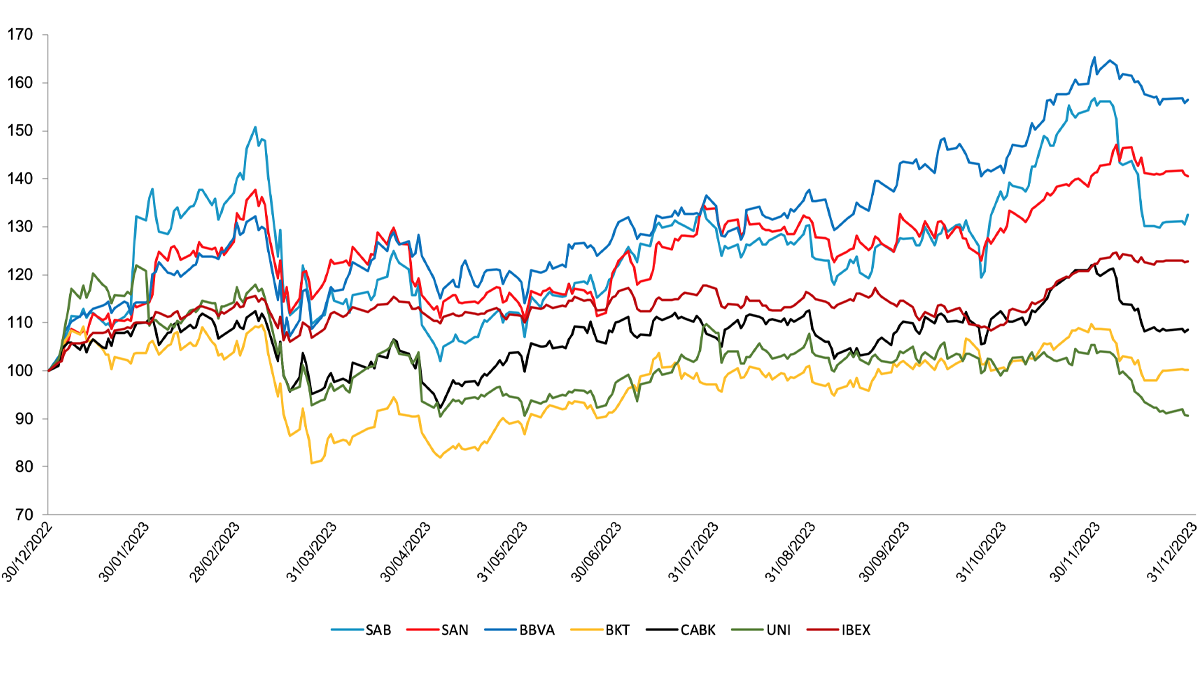

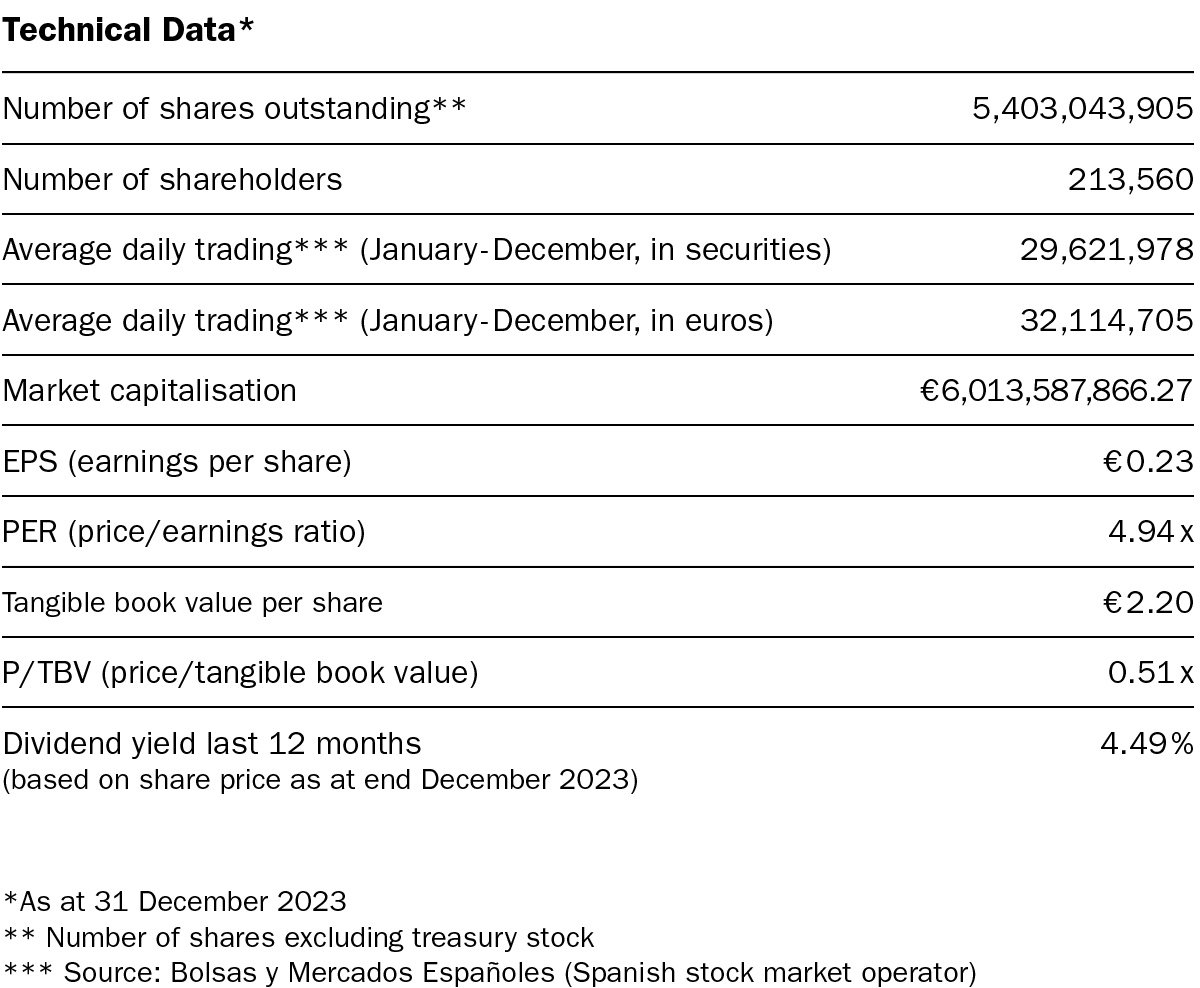

The Sabadell share price ended the year with a revaluation of +33%, placing it above the average of its Spanish peers (+19%). Furthermore, considering the revaluation in the period 2021-2023, it is the best performing stock of the IBEX 35 and the third best performing European bank among more than 40 institutions that comprise the European banking sector index.

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

R.I. : 202300197-21-1-11077