In the first quarter of the year, the main economic activity indicators for Spain gave mixed signals, with the labour market remaining strong and the unemployment rate close to record highs while, on the other hand, the leading confidence indicators pointed to a degree of economic fragility. In parallel, the Bank of Spain revised annual GDP growth for 2024 upwards from 1.6% to 1.9% and kept its forecasts for annual growth in 2025 and 2026 unchanged at 2.0% and 1.7%, respectively. Inflation has continued to follow a downward trend, both in Spain and the main developed economies.

The central banks adopted a cautious tone with regard to the disinflationary process, and the market’s expectations around the timing of the first rate cuts were pushed back from March to the summer. In this respect, the main central banks kept their benchmark interest rates unchanged. The European Central Bank revised its inflation forecast for 2024 downwards, swayed by the energy component. Moreover, ECB President Lagarde hinted at the possibility of beginning the rate cut cycle in June. For its part, the Federal Reserve retained a dovish tone by suggesting that it will proceed with rate cuts at some point in the year, despite having revised its inflation and growth forecasts upwards.

At a global level, geopolitics remained the focus of attention, with the conflict in the Middle East generating disruptions to maritime trade passing through the Red Sea. Nevertheless, as these disruptions have been less severe than those which occurred in 2021 and 2022 and have not affected commodities prices, they have had a limited impact on inflationary upswings.

It is worth noting that on 19 March, the ratings agency Moody’s upgraded the rating outlook for Spanish sovereign debt to “positive” and kept the credit rating at Baa1, on the back of the improved macroeconomic environment. This also prompted a ratings review of Spanish financial institutions which, in the specific case of Sabadell, resulted in an upgrade of the Bank's rating outlook from “stable” to “positive”.

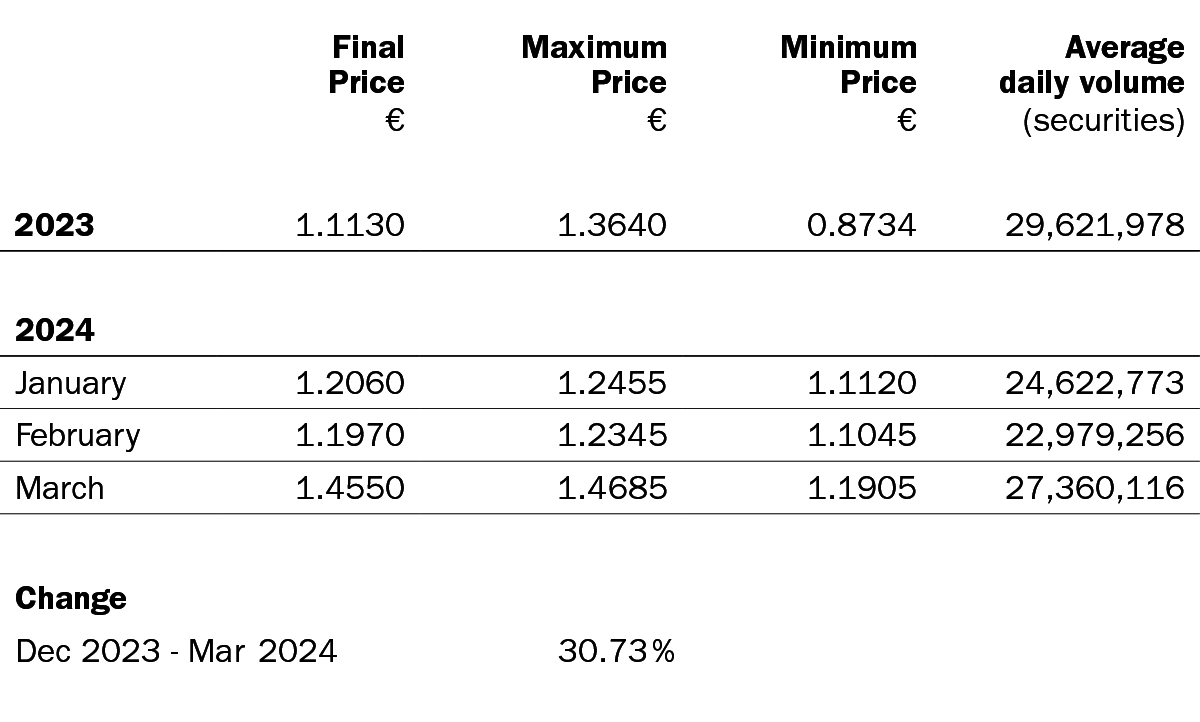

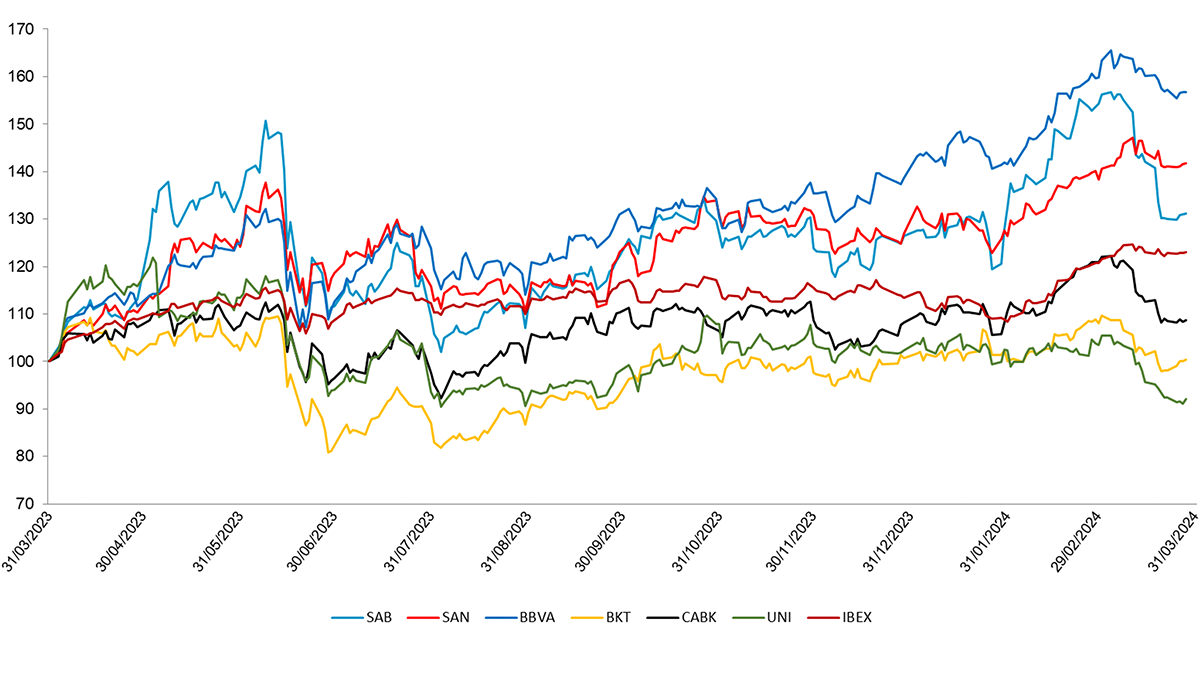

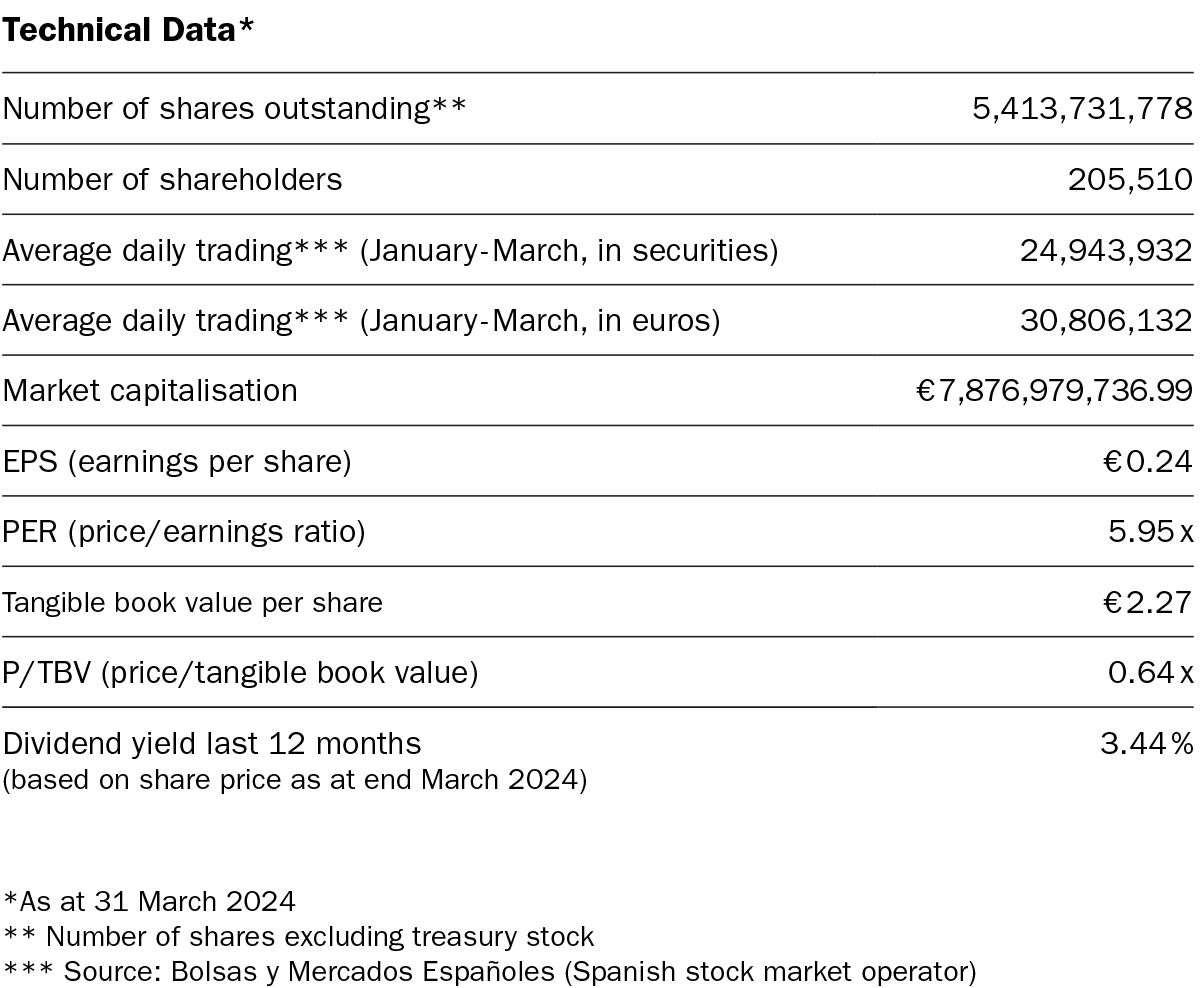

The Sabadell share price ended the quarter with a cumulative revaluation of +30.7%, placing it above the average of comparable Spanish banks (+26.6%) and above the European bank index average (+12.6%).

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

R.I. : 202300197-21-1-11077