Spain’s economy has continued to perform well. GDP carried on growing at a robust pace, underpinned by tourism and retail sales. At the opposite end of the spectrum, job creation experienced a slowdown. Against this backdrop, the Bank of Spain revised its growth forecasts up to 2.8% for 2024 and to 2.2% for 2025.

The positive tone of the Spanish economy was a contrast to the fragility seen in the Eurozone as a whole, particularly in Germany. Indeed, the German government sharply reduced its growth forecasts for this year, in a context in which news in relation to the automotive industry has been negative. Furthermore, political noise in France remained high and the Prime Minister, who is in a minority government, unveiled several measures for tax consolidation that will weigh on the country’s economic growth.

In the political arena, Joe Biden withdrew from the presidential race and his place was taken by current Vice President Kamala Harris. According to recent polls, both candidates now have far more even chances of winning and everything suggests that the end result will depend on a small number of swing states. On the other hand, the conflict between Israel and Hamas escalated in the region and Israel’s offensive reached into southern Lebanon. The impact on oil prices was limited, largely due to the current favourable supply conditions and the expected weakness in demand.

As for central banks, in October the ECB cut official rates for the third time this year, against a backdrop in which the central bank appeared more pessimistic in terms of economic activity and in which inflation came close to the central bank’s target. The Fed, for its part, began its rate cut cycle in September, with a 50bps interest rate cut, showing heightened concerns over the job market and increased confidence in the ongoing disinflation process.

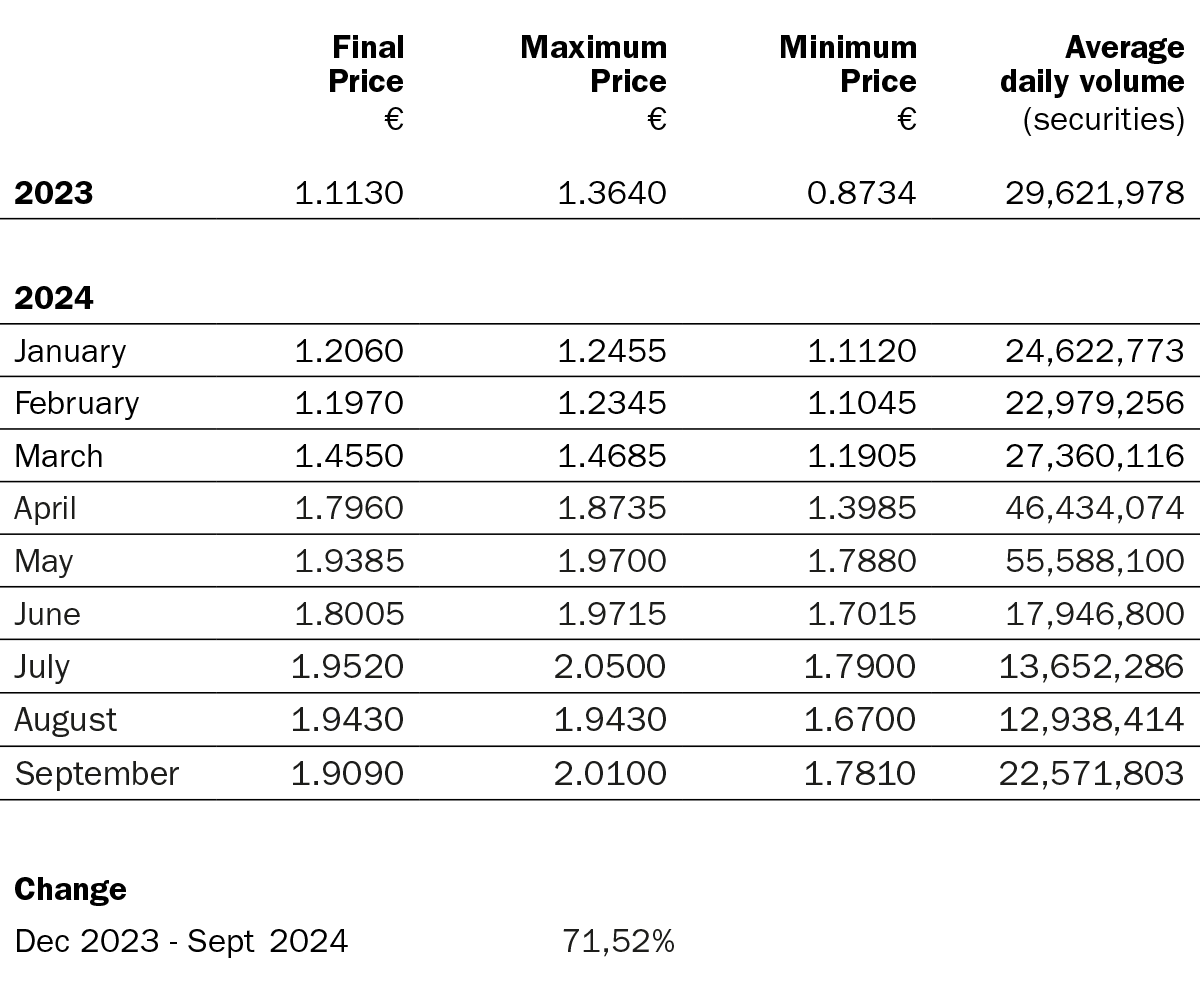

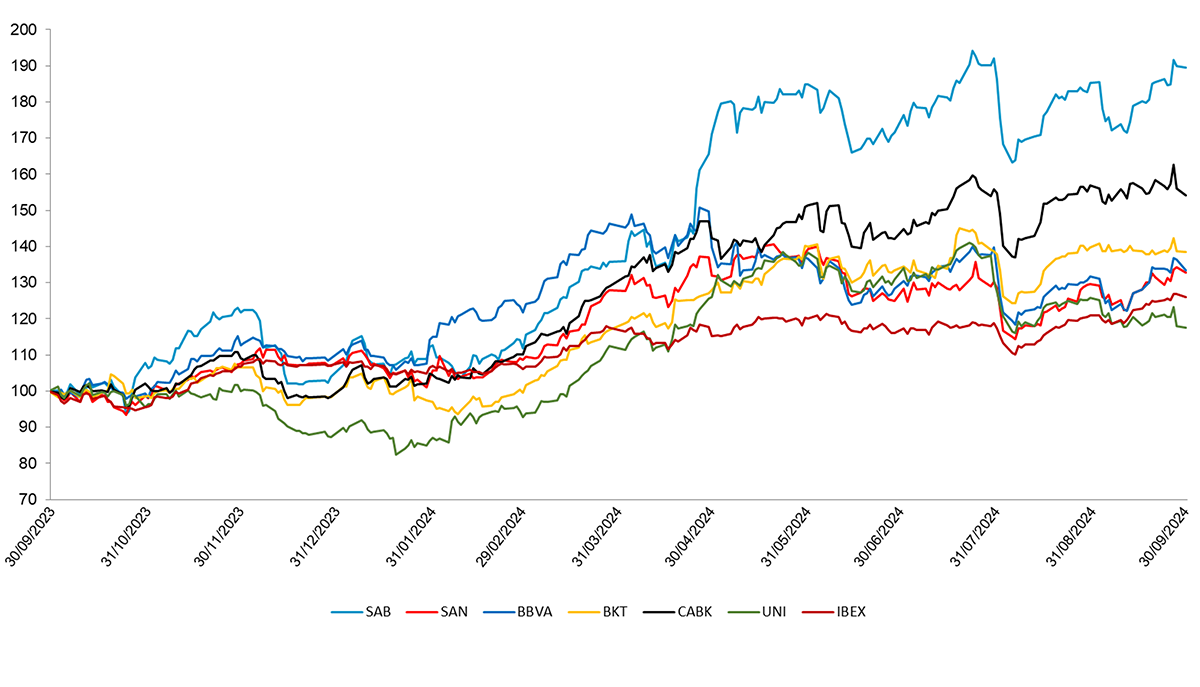

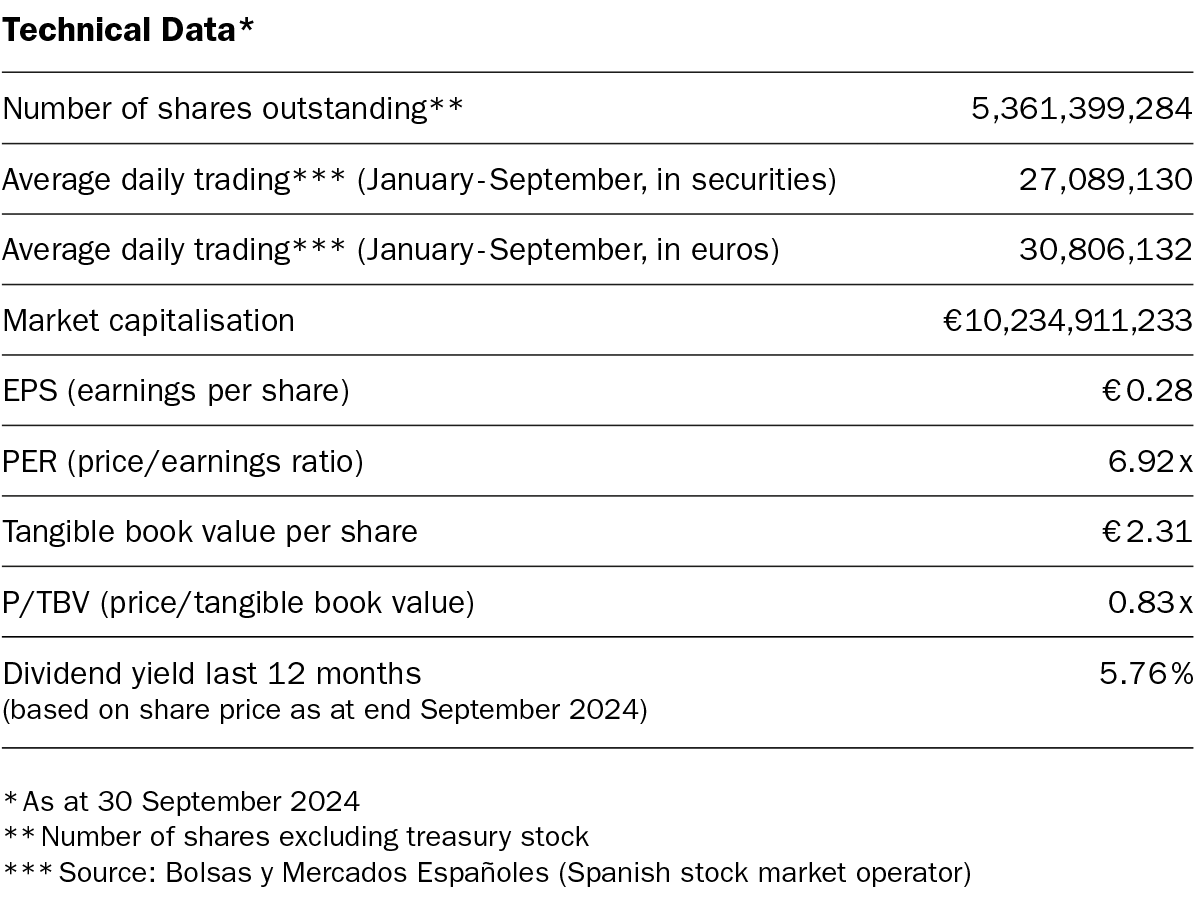

Sabadell’s share price ended the quarter with an adjusted cumulative revaluation of +75.1%, placing it above the average of comparable Spanish banks (+34.5%) and above the European bank index average (+20.3%).

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

R.I. : 202300197-21-1-11077