Donald Trump’s victory in the US presidential election was the most prominent topic of Q4 2024. The Republicans gained control of Congress and the Senate, marking a shift to a single-party administration. Trump’s political agenda features a special focus on tariff increases, an immigration crackdown and the extension of the tax breaks introduced during his first term in office.

In Europe, political noise grew louder in Germany and France. The German government called early federal elections to the Bundestag for 23 February. In France, political instability continued after Barnier’s government collapsed following a vote of no-confidence. Macron subsequently named Bayrou as Prime Minister, tasked with approving a budget for 2025.

Economic activity data in Q4 2024 showed signs of robustness in the US economy and ongoing weakness in the Eurozone, against a backdrop in which inflation slowed on both sides of the Atlantic. In the Eurozone, the latest business confidence indices indicated anaemic growth in the last quarter. German GDP contracted by 0.2% in 2024, which was the first time since the early 2000s that the country recorded two consecutive years of contraction.

In Spain, the economy continued to perform well and GDP grew by 3.2% in the full year 2024. The good performance of certain economic sentiment indicators and the good momentum of the labour market were also noteworthy. In terms of prices, inflation ended the last few months of the year rebounding to 2.8%, driven by more expensive fuel prices and, to a lesser extent, higher prices in the service sector. Headline inflation for the full year 2024 stood at 2.9%, the same rate as core inflation.

In terms of economic policy, it is worth mentioning the aid packages introduced by the government to remedy the effects of the DANA flash floods in the province of Valencia and surrounding areas, valued at 16.6 billion euros. A number of fiscal measures were also approved, including a 15% floor on corporation tax for large corporates and an extension of the bank levy. Lastly, the government also approved, by means of a decree, its reform of active and partial retirement, as well as a decree containing various social measures, such as the extension (to June) of discounted prices on public transport, the revaluation of pensions to match inflation, and the extension of the ban on evictions and utilities cuts for vulnerable families.

In terms of monetary policy, the ECB continued to cut official interest rates, placing the deposit facility rate at 3.00% in December. Overall in 2024, the central bank cut its deposit facility rate by 100bps. The ECB insisted that it will maintain a data-dependent approach and did not commit to any particular path of interest rate cuts. The Federal Reserve, for its part, reduced the target range of the Fed Funds rate by 50bps to 4.25-4.50% in Q4 2024, in a context in which the central bank appeared more confident that inflation is nearing the 2% target and considered that risks were fairly evenly balanced. The Bank of England continued the rate-cutting cycle with a further cut of 25bps bringing its base rate to 4.75%.

Long-term government bond yields rebounded on both sides of the Atlantic, especially in the United States. This was due to Trump’s electoral win, the upward revision of interest rate expectations by the Fed in its December meeting and certain upside surprises in terms of macroeconomic data in the United States. The risk premiums on European government bonds performed well, except for France, where their spread was weighed down by the collapse of Barnier’s government and downgrades of the country’s sovereign debt rating by Fitch and Moody’s. France’s risk premium therefore climbed to its highest since 2012.

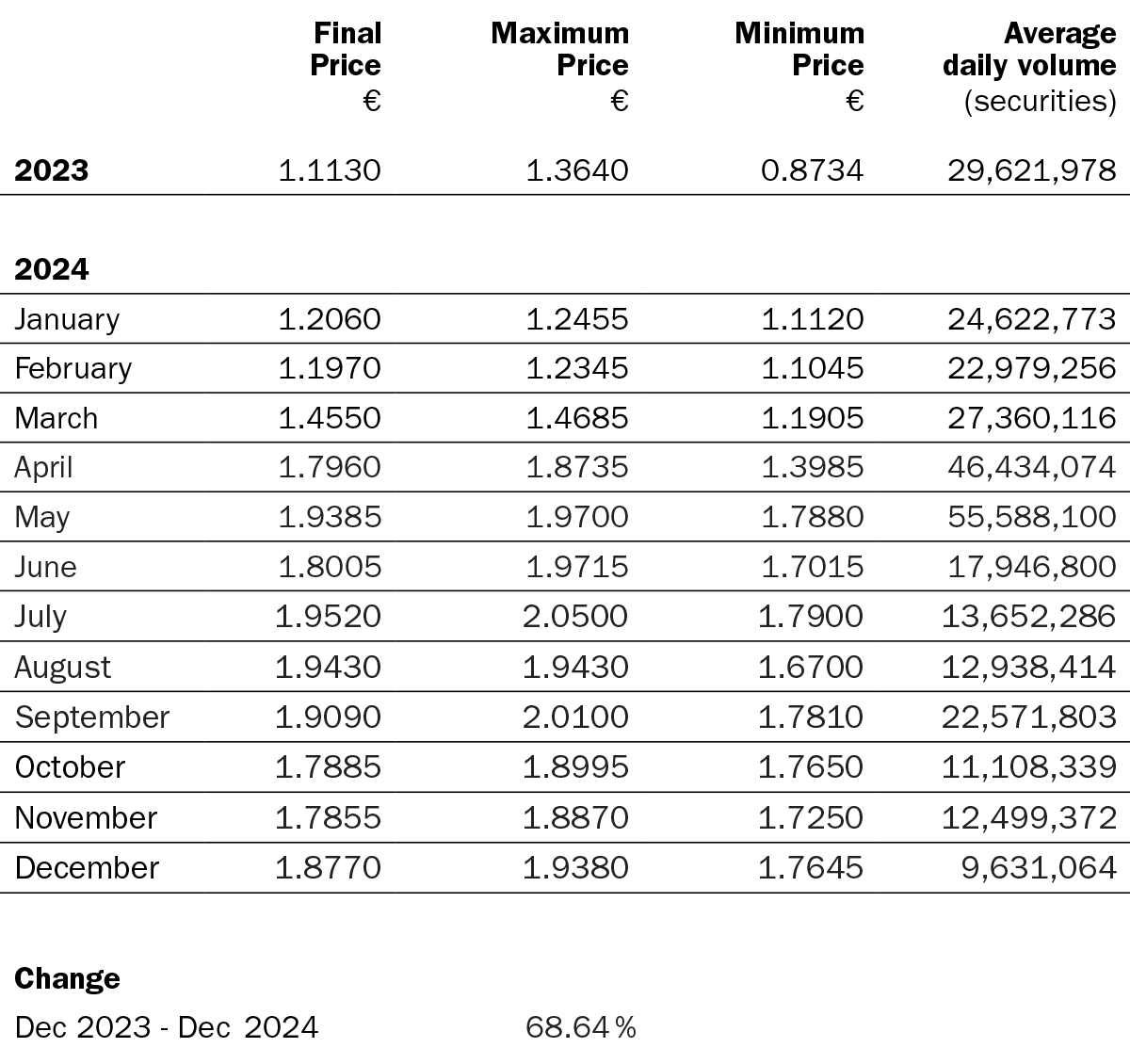

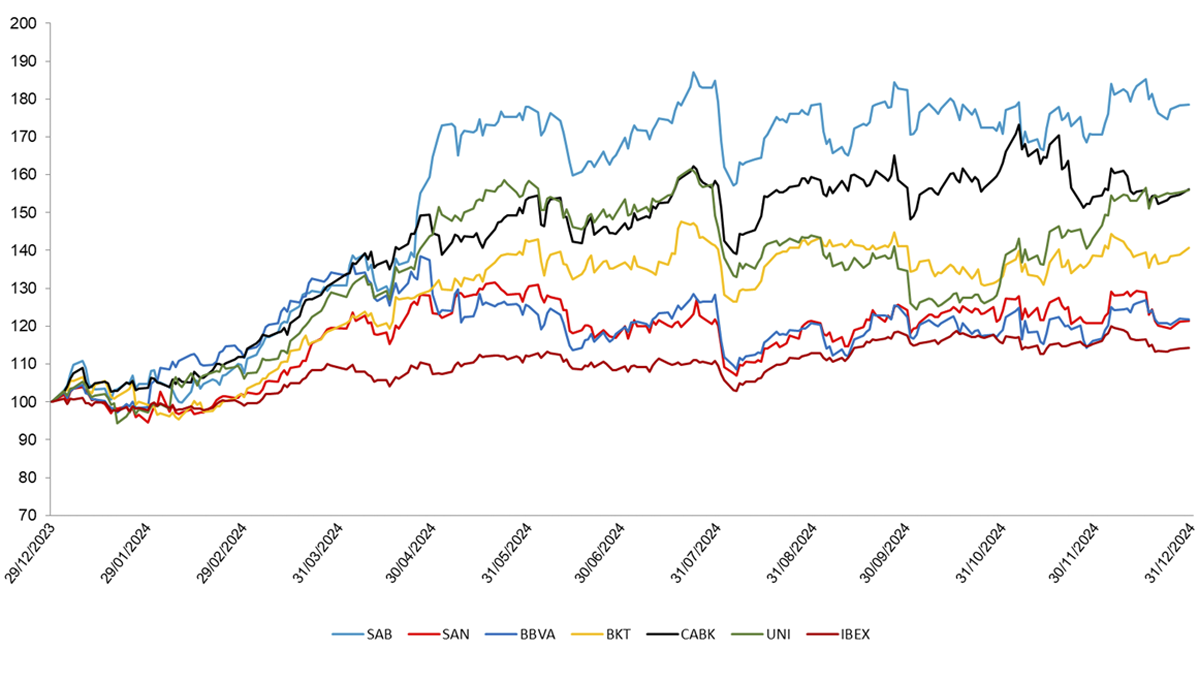

Banco Sabadell’s share price ended 2024 with a revaluation of +79%1, making it the second best performing IBEX 35 stock in the year and the top ranking institution among the Spanish banks listed on that index. This performance placed it above the average of its Spanish peers (+40%) and above the European banking sector average (+26%).

1. Adjusted for capital increases, dividends, stock splits, etc.

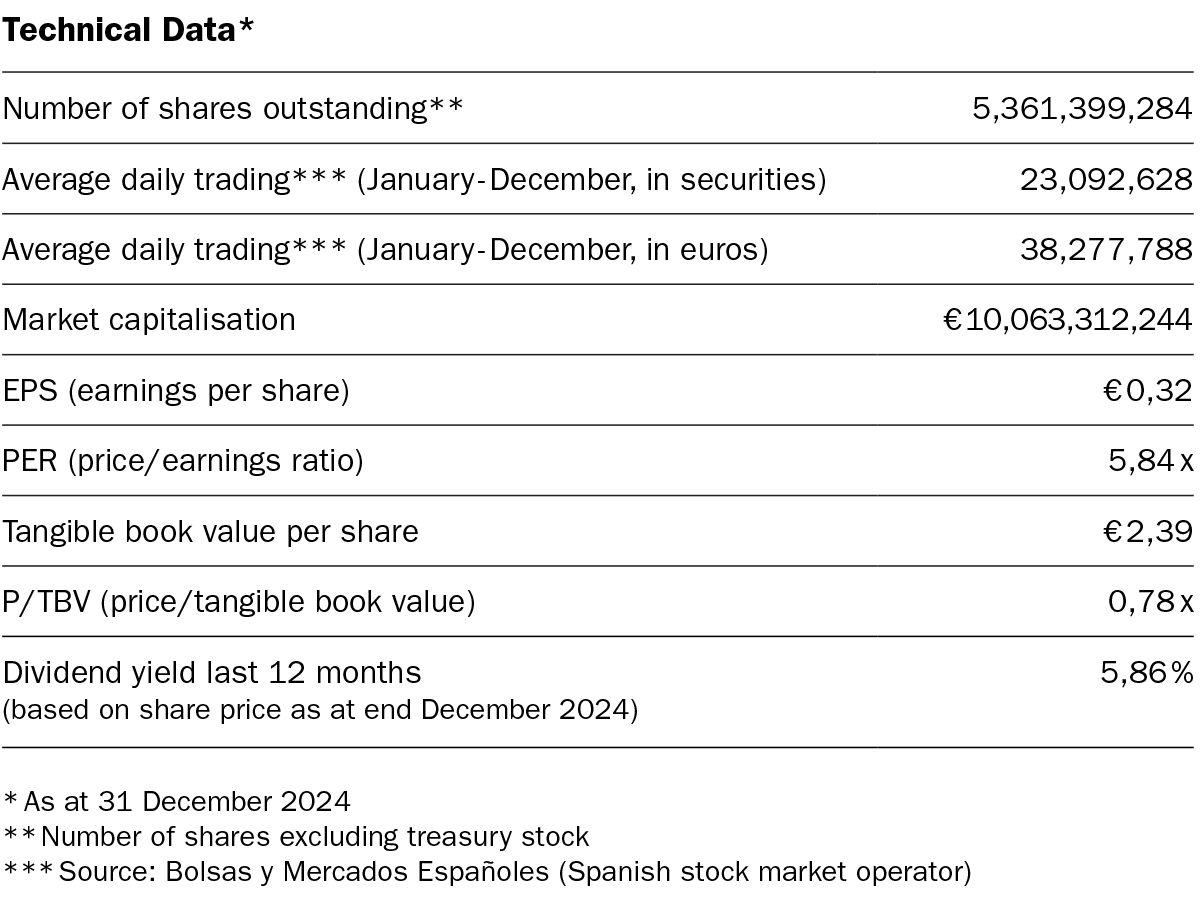

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

*Source: Bloomberg. Data rebased to 100 at the start of the period, adjusted for capital increases, dividends, stock splits, etc..

(i) Share price evolution includes the revaluation of Banco Sabadell’s share price on the 30 April 2024, the trading day when BBVA announced its unilateral proposal for a merger with Banco Sabadell, when the share price increased by 6 euro cents.

(ii) Past performance is no guarantee of future returns.

R.I. : 202300197-21-1-11077