The Trump government has established various tariff measures with the rest of the world. In particular, it has established a general tariff of 10% and put additional “reciprocal” tariffs on hold for 90 days, except in the case of China, with which rates continued to escalate before reaching a total tariff of 145%. In parallel, it has established a 25% tariff on imports from Mexico and Canada if they fail to comply with the T-MEC treaty, and a tariff of 25% on steel, aluminium and automotive imports.

China was the only country to respond to the tariff increase with countermeasures, and ended up establishing a tariff of 125% on imports from the United States, in addition to other measures. The EU, for its part, adopted more of a negotiating stance and kept on hold (also for 90 days) the introduction of retaliatory measures for the US tariffs on steel and aluminium.

The stock markets slumped with falls that have not been seen since Covid, accompanied by significantly increased volatility. Despite this environment of risk aversion, the yield on US treasury bonds spiked sharply; this was not observed in the case of German bonds. Much of these movements were subsequently reversed. But in any case, the dollar weakened against most currencies. On the upside, peripheral risk premiums barely rose.

With regard to monetary policy, the ECB continued to lower the deposit rate, bringing it down to 2.25% at its April meeting. For their part, members of the Federal Reserve remained hawkish on interest rates. The markets are pricing in two further cuts of 25 bps by the ECB this year, which would bring the rate to 1.75%, and three for the Federal Reserve.

Trade uncertainty is reflected in the deterioration of certain confidence indicators and also in downward revisions to consensus growth forecasts for different regions and countries, and particularly for the United States. Coincident indicators, however, have generally continued to demonstrate resilience on a global scale.

Elsewhere, the German Parliament approved a constitutional reform that will allow the future government to carry out a historic fiscal stimulus, which will be focused on boosting infrastructure investments and increasing defence spending. The European Commission also unveiled measures to make fiscal regulations more flexible so that European governments may increase their defence spending in the coming years, in response to the United States’ growing disengagement from European defence.

In Spain, activity in 1Q25 slowed slightly, although it continued to perform well despite the complex global environment. In this respect, GDP grew by 0.6% quarter-on-quarter in 1Q25 (0.7% in 4Q24), with slower growth of household consumption and capital investment compared to the previous quarter, partially offset by improved exports of services. In terms of the labour market, the unemployment rate recorded seasonal growth in 1Q25, increasing from 10.6% to 11.4%, although the seasonally-adjusted unemployment rate continued to fall. Looking ahead, business confidence indicators signal that good growth dynamics will generally be maintained, while various bodies, such as the IMF for example, continue to rank Spain among the Eurozone countries that will grow most in 2025 (IMF forecast for Spain: 2.5% vs 0.8% in the Eurozone overall).

With regard to the tariffs announced by the United States, the Spanish economy is relatively insulated from these. The United States tariff policy should have a limited direct impact on Spain due to its reduced trade exposure to this country. Estimates produced by the Bank of Spain indicate that a tariff of 10% could represent one tenth of GDP.

On the other hand, the negative impact of tariffs will be counterbalanced by: (i) inertial growth of the economy; (ii) the significant relative weight of services; (iii) the rollout of the NextGeneration EU funds; (iv) the much lower interest rate environment; (v) the favourable financial situation of families and businesses; (vi) the response of the European and Spanish authorities; and (vii) the repercussions of the fiscal stimulus plan in Germany.

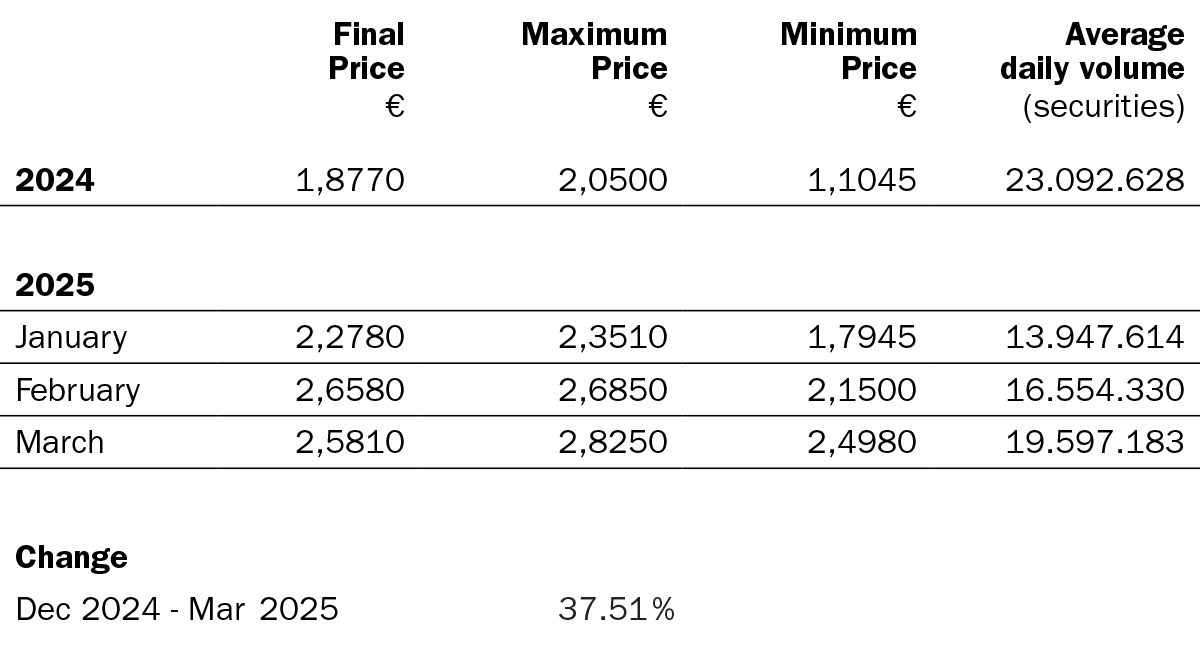

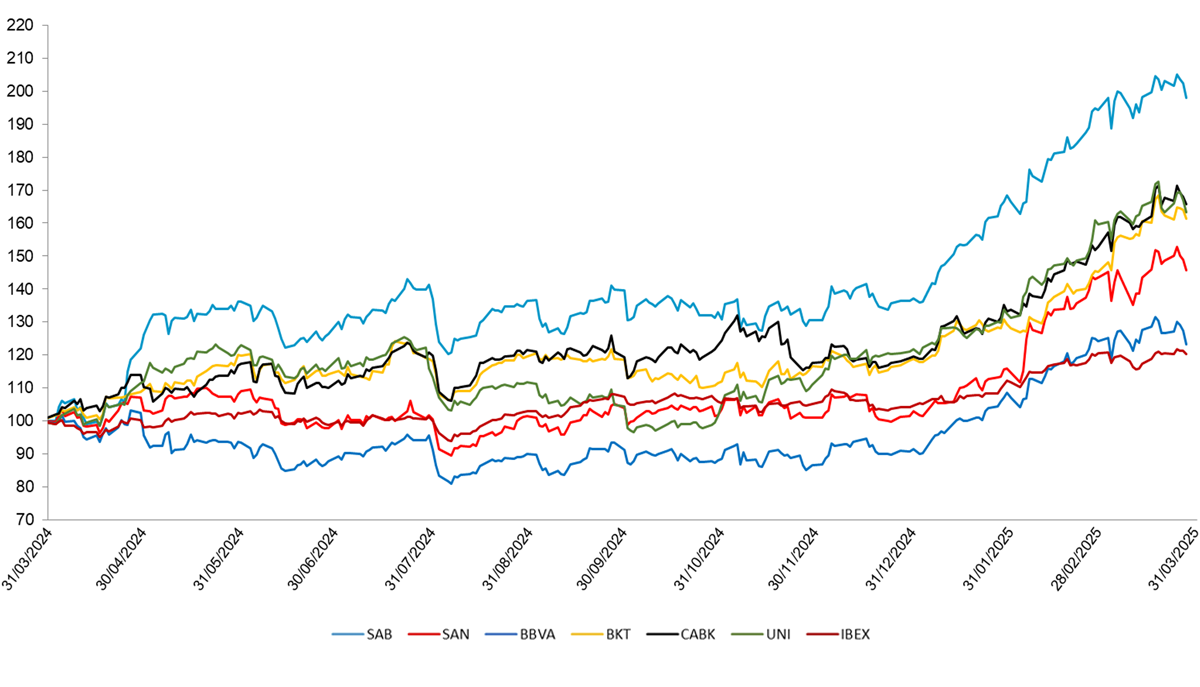

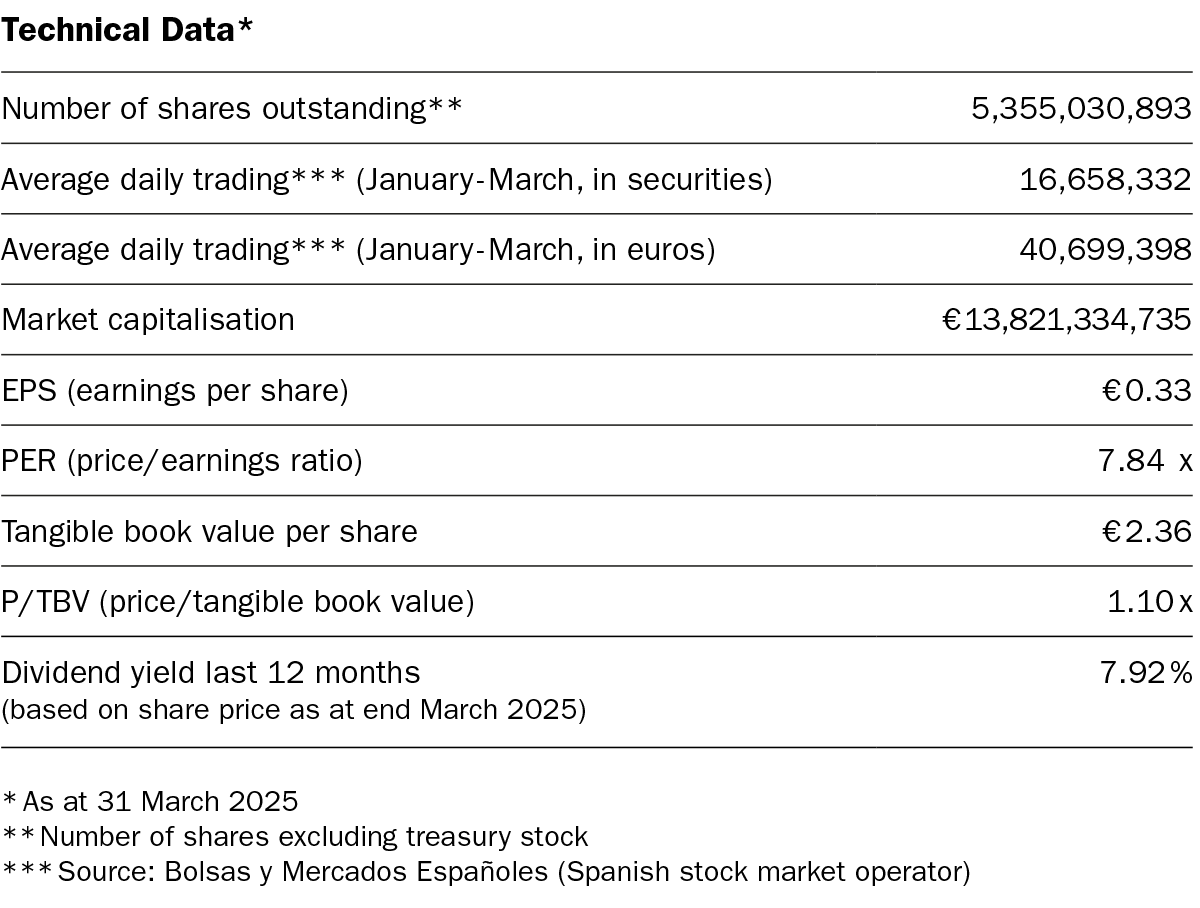

Regarding Banco Sabadell’s share price, in the first three months of 2025 it recorded a remarkable revaluation of 43.9%, outperforming the Spanish banking sector average of 35.3%, making it the second-best performing stock on both the IBEX 35 and the European bank sector index. This strong performance reflects investors’ confidence in the Bank’s strategy and management.

On 20 March, Banco Sabadell held its Annual General Meeting in Sabadell, where all of the items on the Agenda were approved, thereby consolidating shareholder support for the Institution’s strategic decisions.

On 10 January 2025, Fitch upgraded Banco Sabadell’s long-term credit rating from BBB+ to BBB and has maintained its stable outlook. This upgrade was due to the strengthening of Banco Sabadell’s asset quality, profitability and capitalisation, as well as an improved assessment of the Spanish banking sector’s operating environment. Furthermore, on 27 March, S&P Global Ratings upgraded Banco Sabadell’s rating from BBB- to A-, with a stable outlook. This upgrade implies that the Bank’s Tier 2 issues are now considered investment grade by the three main credit rating agencies, which further strengthens the perception of the Institution’s financial solidity.

In terms of shareholder remuneration, a final dividend of 12.44 euro cents per share was paid out on 28 March 2025, underscoring the Bank’s commitment to its shareholders. Additionally, on 31 March 2025, the first share buyback programme was launched, for a total of 247 million euros. This measure is intended to optimise the capital structure and generate additional shareholder value. Once completed, the second share buyback programme will be launched, for 755 million euros.

Banco Sabadell continues to demonstrate its ability to adapt to a challenging economic environment, maintaining a strategy focused on creating sustainable value and on strengthening its competitive position in the European banking sector.

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

*Source: Bloomberg. Data rebased to 100 at the start of the period, adjusted for capital increases, dividends, stock splits, etc..

(i) Share price evolution includes the revaluation of Banco Sabadell’s share price on the 30 April 2024, the trading day when BBVA announced its unilateral proposal for a merger with Banco Sabadell, when the share price increased by 6 euro cents.

(ii) Past performance is no guarantee of future returns.

R.I. : 202300197-21-1-11077