In the third quarter of 2025, tariff-related news continued to be a global focal point. The trade agreement reached between the United States and the EU established a 15% tariff on most imports from Europe into the U.S.

Despite the tariff war, global trade continued to show resilience, supported by:

(i) anticipation of trade flows; (ii) a lower level of retaliation than initially expected;(iii) resilient trade among emerging countries; and (iv) trade related to Artificial Intelligence.

In the geopolitical sphere, Trump continued to fall short of his goal to quickly end the conflict in Ukraine. In fact, Russia increased its attacks on Ukraine while intensifying hybrid threats against Europe. In the Middle East, Israel advanced its military control over Gaza and took steps toward greater control of the West Bank, which increased Western pressure to end the conflict in the Strip. Trump and the Israeli Prime Minister agreed on a peace plan for Gaza, whose implementation has been partial, and there are doubts about its ability to resolve the region’s structural conflicts.

In fiscal matters, the main focus was France, where the risk premium deteriorated during the quarter, reaching highs not seen since January due to political instability, difficulties in passing reforms to reduce the public deficit, and rating downgrades (placing France below AA-). Meanwhile, country risk premiums in the European periphery narrowed, thanks to rating upgrades for Spain and Italy.

Despite high global uncertainty, major economies continued to show resilience, and risk assets continued to post gains in financial markets.

In Spain, Q3 2025 GDP performed well, growing 0.6% quarter-on-quarter. Private consumption and investment showed strong performance, while the decline in goods exports led to a negative contribution from the external sector.

In this context, several economic institutions revised Spain’s growth forecasts upward, to values close to 3.0% for this year and 2.0% for 2026.

Regarding inflation, it remained in line with the ECB’s target in the eurozone (Sep 2025: 2.2% year-on-year), and the central bank declared the disinflation process complete. In the United States, prices remained above the Fed’s target (2.9% year-on-year in August).

On monetary policy, the ECB kept the deposit rate unchanged at 2.00%, while Lagarde suggested that the rate-cutting cycle was over, considering the central bank to be in a good position regarding interest rates.

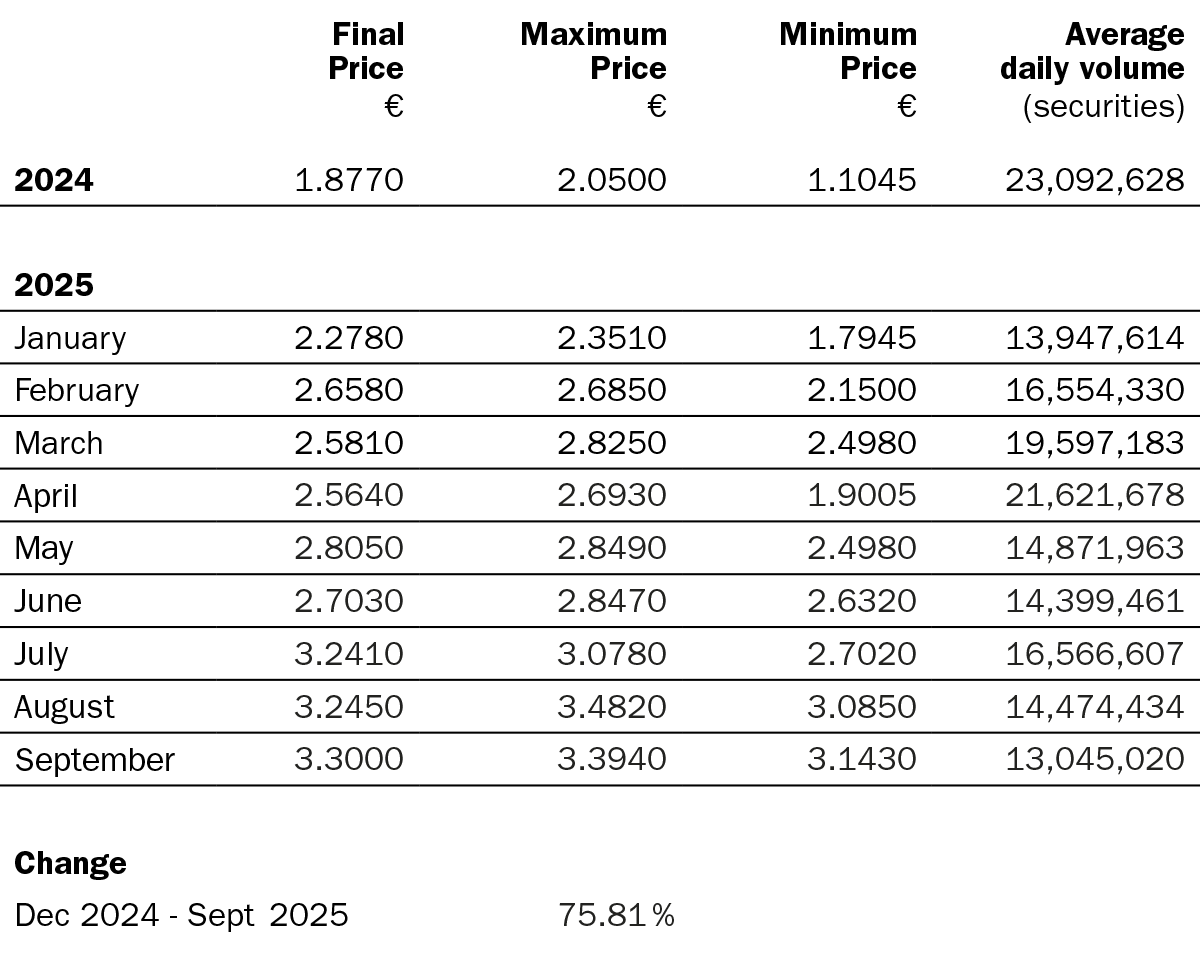

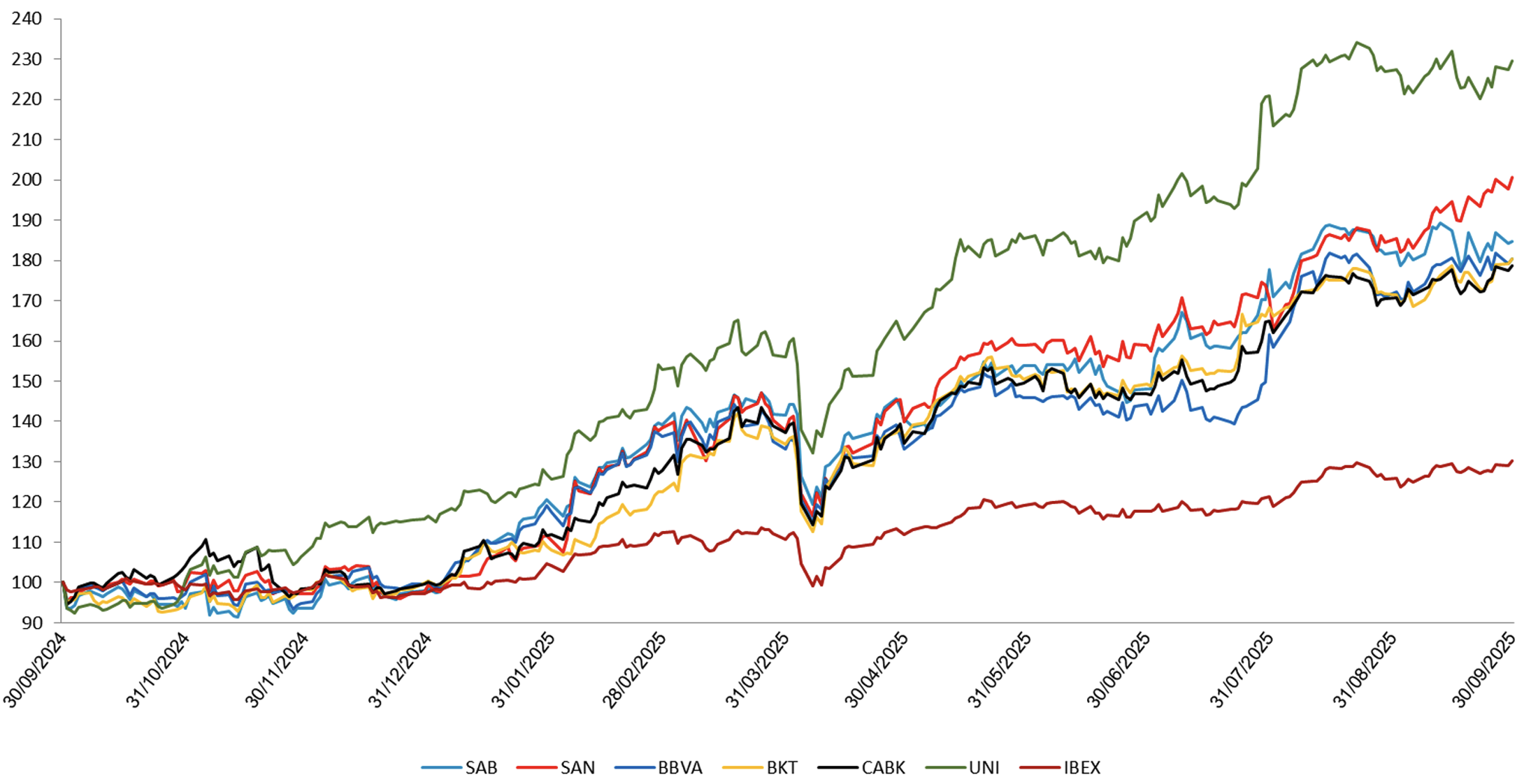

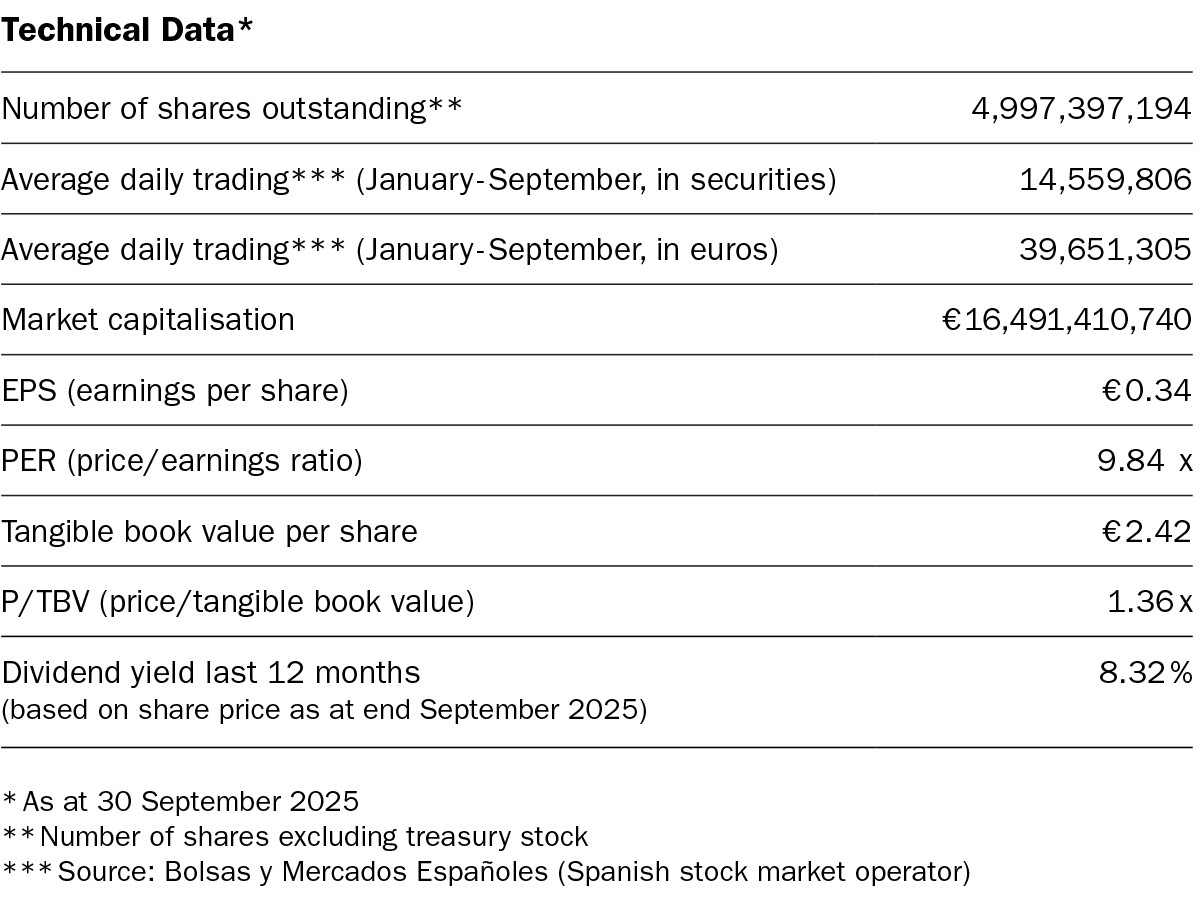

Sabadell’s stock closed September with a year-to-date revaluation of +87.8%, adjusted for dividends, in line with the average of comparable Spanish banks1 (+85.2%) and above the European banking index (+46.0%).

1. Comparable Spanish banks include CaixaBank, Bankinter, and Unicaja.

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

Source: Bloomberg. Data rebased to 100 at the start of the period, adjusted for capital increases, dividends, stock splits, etc.

(i) Past performance is no guarantee of future returns.

R.I. : 202500054-28-1-20129