This 4Q25, geopolitics has remained in the spotlight for investors.

The United States carried out a military intervention in Venezuela, aligned with its new national security strategy, which seeks to strengthen its influence throughout the entire American continent. Trump has also threatened other Latin American countries and has insisted on taking control of Greenland.

Regarding the conflict in Ukraine, negotiations for a potential peace agreement have continued, although Russia has continued to oppose making concessions.

News related to the tariff war has been somewhat more positive. The United States and China agreed on a reduction of tariffs and the reactivation of agricultural purchases in exchange for easing trade tensions and relaxing controls on key exports. The EU prime ministers agreed to sign the trade agreement between the EU and Mercosur. Approval from the European Parliament is still needed for it to enter into force.

The global economy has shown resilience despite high uncertainty.

The U.S. economy has shown significant dynamism, supported by major investments related to AI. On the negative side, the weakness of the labor market has continued to stand out.

In the eurozone, the economy is also showing significant resilience, given the context of high uncertainty. In addition, Germany recorded economic growth in 2025 (0.2%) after three years of contraction.

In Spain, the economy remained solid. The Bank of Spain published its forecasts, predicting that growth in 4Q25 will stand between 0.6% and 0.7% quarter-on-quarter (3Q25: 0.6%) and revising upwards the expected growth for 2026, to 2.2%, and for 2027, to 1.9% annually.

The central banks of major developed economies have moved or placed benchmark rates near monetary neutrality.

The Fed cut benchmark rates by 75 bps throughout the quarter, to the 3.75%–3.50% range, and Powell suggested there could be a pause in the rate cutting cycle despite labor market weakness. On the other hand, the Trump administration increased pressure on the Fed’s independence by launching a criminal investigation into Powell.

The ECB, for its part, made no changes to the deposit rate (2.00%). In December, Lagarde struck a neutral tone, avoiding commitment to any specific rate path.

Financial markets have performed positively despite elevated geopolitical uncertainty.

The main stock indices of developed economies delivered a favorable performance, supported, among other factors, by the resilience of the global economy, the resolution of the U.S. government shutdown, and the easing of trade tensions between China and the United States, despite concerns about technology sector valuations.

Government bond yields were pushed higher on both sides of the Atlantic due to expectations of rate hikes from the Bank of Japan and increased sovereign issuance expected for 2026. Meanwhile, European peripheral country risk premiums narrowed over the quarter, supported by rating upgrades for Spain and Italy.

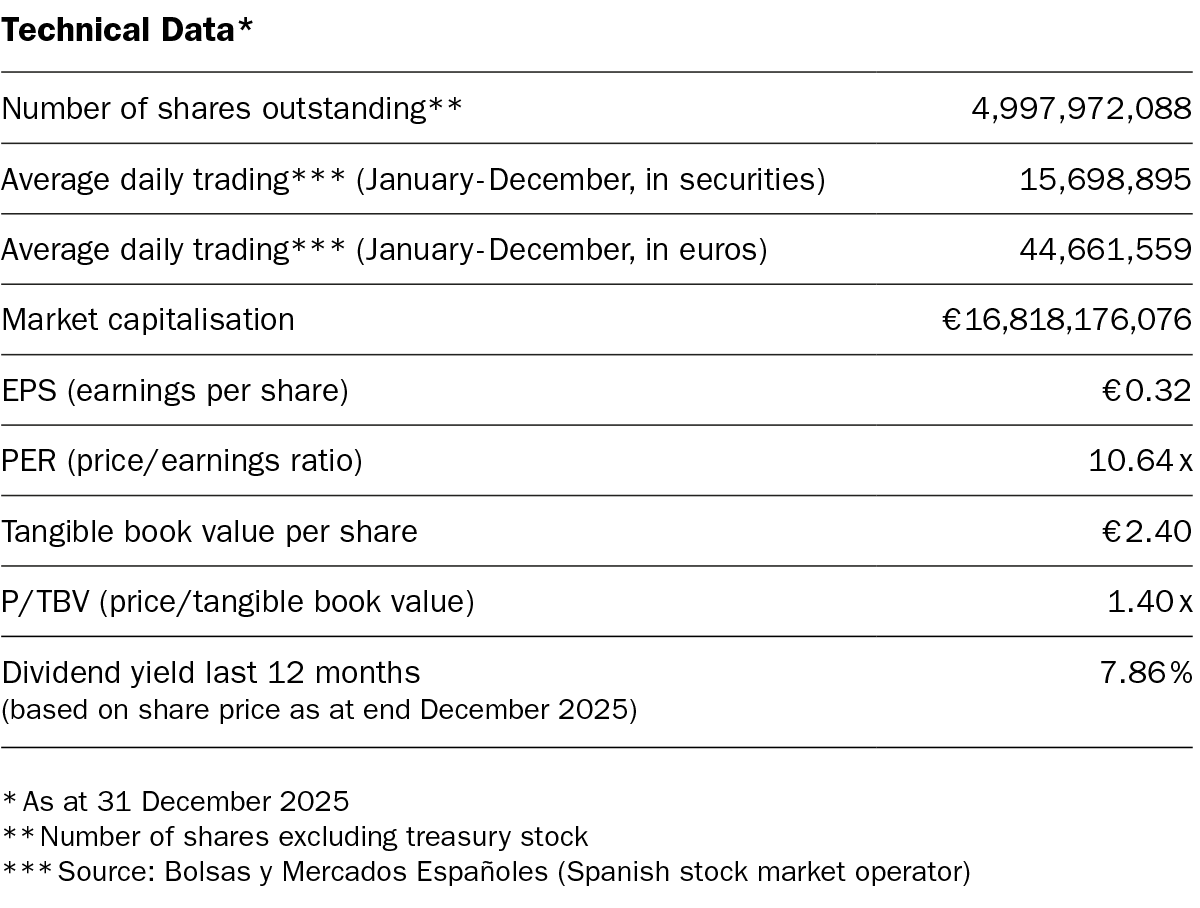

Regarding news related to Banco Sabadell, the credit rating agency S&P improved the rating outlook during the quarter from Stable to Positive, thanks to expectations of increasing loss absorption buffers in the medium term and solid prospects in profitability and credit quality.

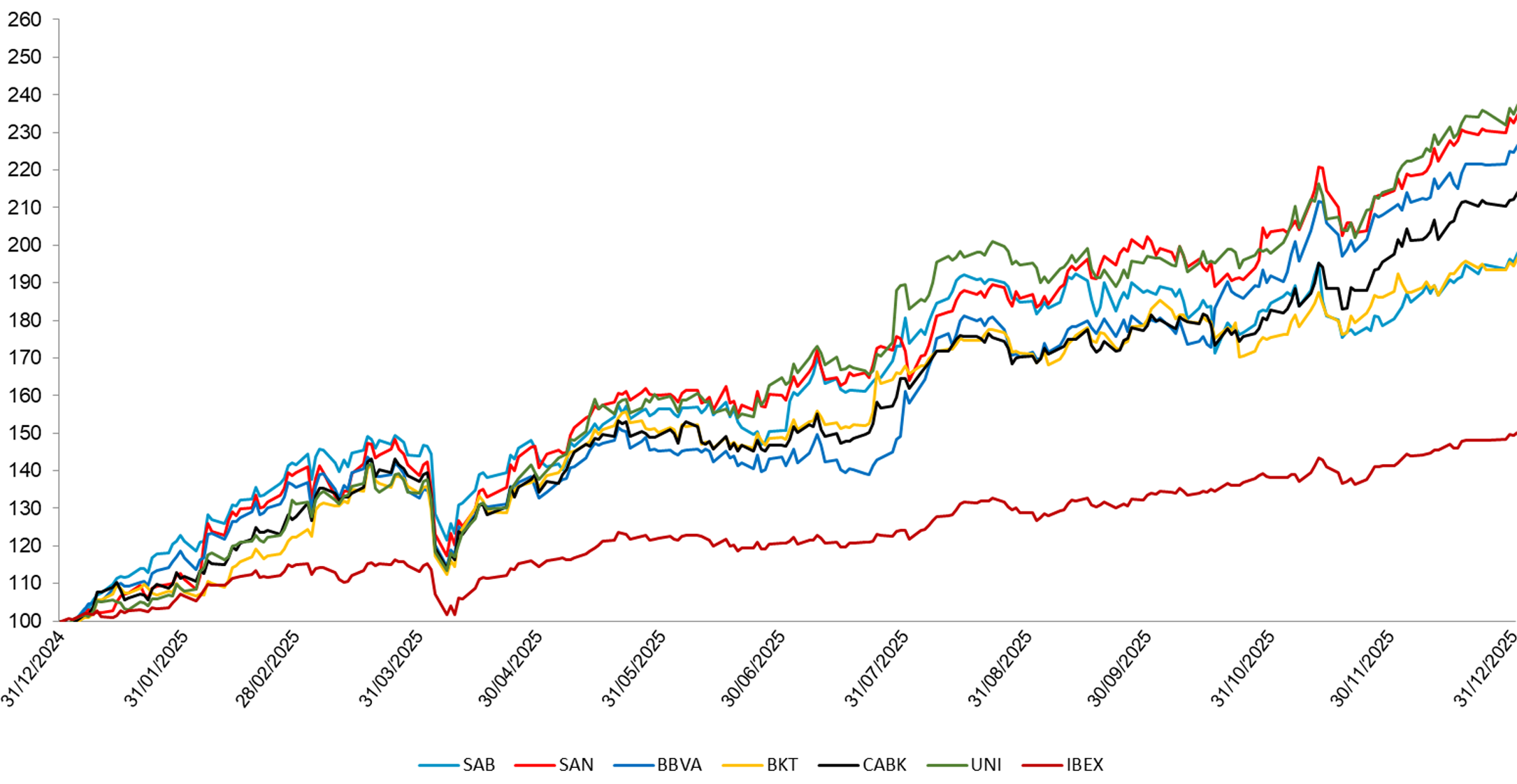

Finally, Sabadell’s share closed the year with a cumulative return of +96% including dividends, below the average of comparable Spanish institutions1 (+114%) but above the European banking sector (+67%).

1. Comparable Spanish banks include CaixaBank, Bankinter, and Unicaja.

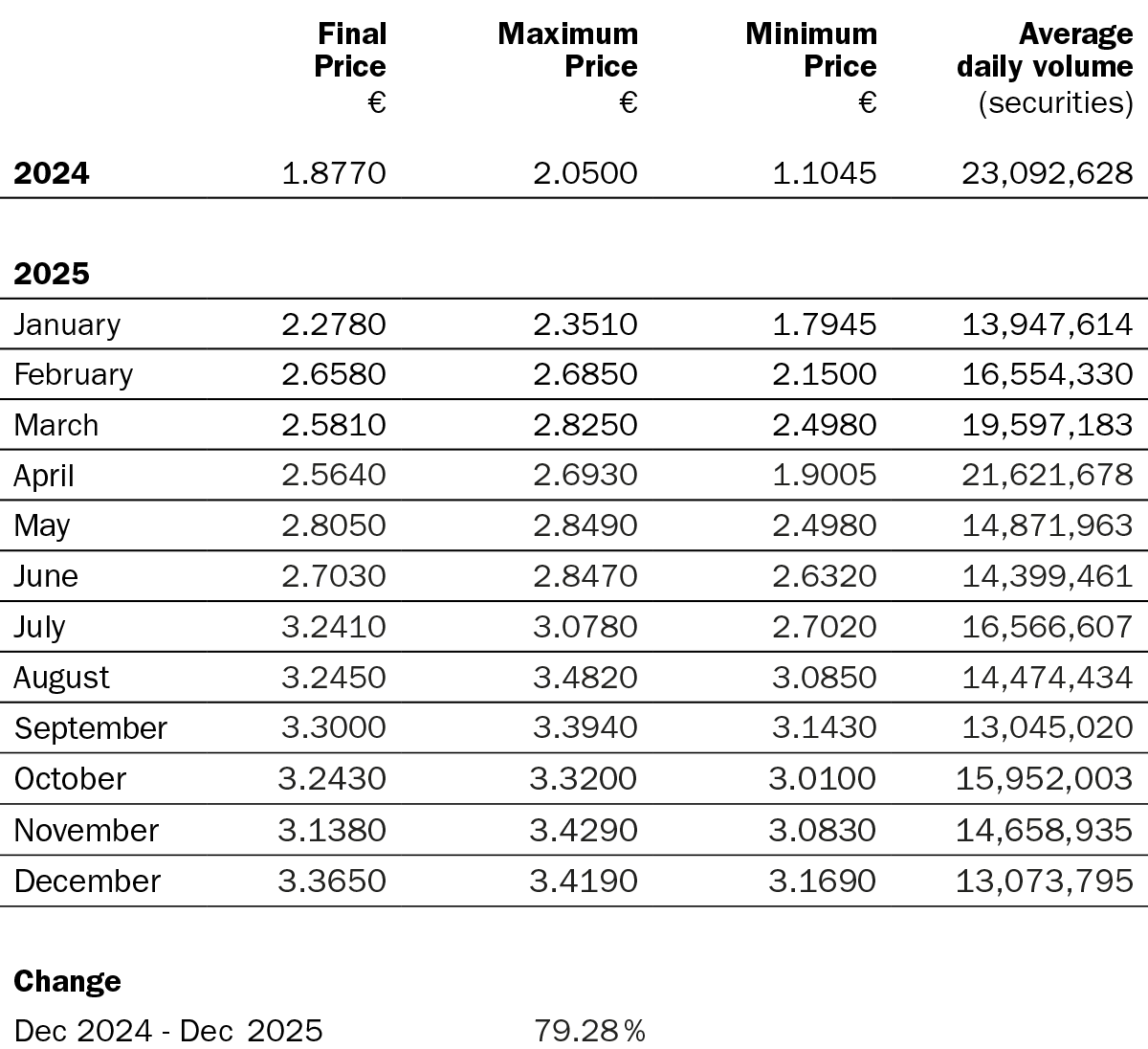

*Source: Bolsas y Mercados Españoles (Spanish stock market operator)

Source: Bloomberg. Data rebased to 100 at the start of the period, adjusted for capital increases, dividends, stock splits, etc.

(i) Past performance is no guarantee of future returns.

R.I. : 202600016-3-1-21287