Triple Plan

2015 has been the second year of the Strategic Triple Plan.

Transformation

- Sales

- Balance Sheet

- Production model

Profitability

- Leveraging greater

scale into profit

Internationalisation

- Preparing for the group’s

international expansion - Entering new markets

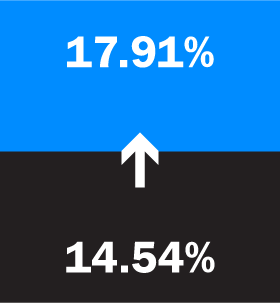

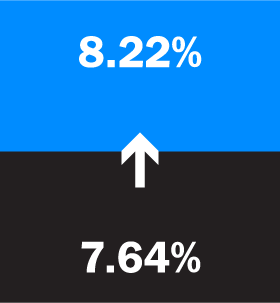

Profitability

Sabadell (ex-TSB) +17.9% Group

+41.7%

Sabadell (ex-TSB)

+7.4% Group

+16.5%

+7.6%

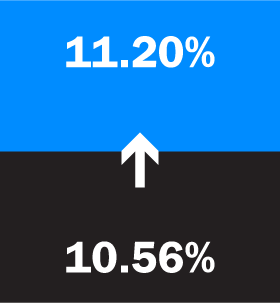

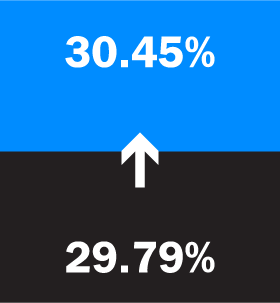

Market shares in Spain

to corporates

credit

invoicing

- 2015

- Dec. 2014

invoicing

products

Household deposits

- 2015

- Dec. 2014

Transformation

Sales transformation

We have led the digital transformation and improved customers’ experience (trust, delivery of service, transparency and convenience).

Towards digital transformation

There, wherever you are

Transformation of the balance sheet

(Dec. 2013 – Dec. 2015)

5,500M€ -22.4%

(Dec. 2013 – Dec. 2015)

4,500M€ -12.8%

16% more than in the previous year and with lower discounts

1,902units

Deposits +1.9% MMF +36.4%

Loans and advances (ex. non-performing loans and TSB)

+2.1% Mortgages (new loans ex-TSB) +39%

-4.95%

Transformation of production model

The cost/income ratio improves on a like-for-like basis. Personnel and administrative costs on a like-for-like basis are maintained.

Internationalisation

- UK

- USA

- France

- Morocco

- Algiers (Algeria)

- Sao Paulo (Brazil)

- Beijing (China)

- Shanghai (China)

- New York (USA)

- Dubai (UAE)

- New Delhi (India)

- Mexico City (Mexico)

- Warsaw (Poland)

- Singapore (Singapore)

- Istanbul (Turkey)

- Caracas (Venezuela)

- Santo Domingo (Dominican Republic)

- Bogota (Colombia)

- Lima (Peru)

- London (UK)

- Andorra

- Miami (USA)

- Mexico City (Mexico)

- Portugal

- Colombia

Acquisition of TSB

TSB (TSB Banking Group PLC) was acquired by the Banco Sabadell group in June 2015 through a takeover bid.

It manages the retail business in the United Kingdom, including current and savings accounts, personal loans, cards and mortgages.

TSB has a multi-channel distribution model on a national scale, formed of 614 branches throughout England, Wales and Scotland.

TSB is a sound challenger bank and has placed Sabadell in a position for future growth in the UK market.

Key figures in 2015